Medicare price negotiation: Putnam’s round one picks

Background and introduction

As provisions of the Inflation Reduction Act (IRA) of 2022 begin to take effect, Putnam continues to analyze the implications. Leveraging Putnam’s proprietary Medicare Price Negotiation Database, this paper outlines our predictions regarding drugs likely to be impacted by Medicare Price Negotiation in 2026 and touches on implications in subsequent years. This database was developed based on a comprehensive review of the most recent Medicare Part B and Part D “Spending by Drug”1 that is available from CMS (2021), drug-specific sales projections from external analysts, product approval and expected loss of exclusivity (LOE) dates, and an analysis of eligibility for exclusion from Medicare price negotiation based on other conditions as outlined in the Inflation Reduction Act of 2022 (e.g., small biotech drugs, drugs approved for orphan diseases, etc.).

Overview of the Inflation Reduction Act of 2022

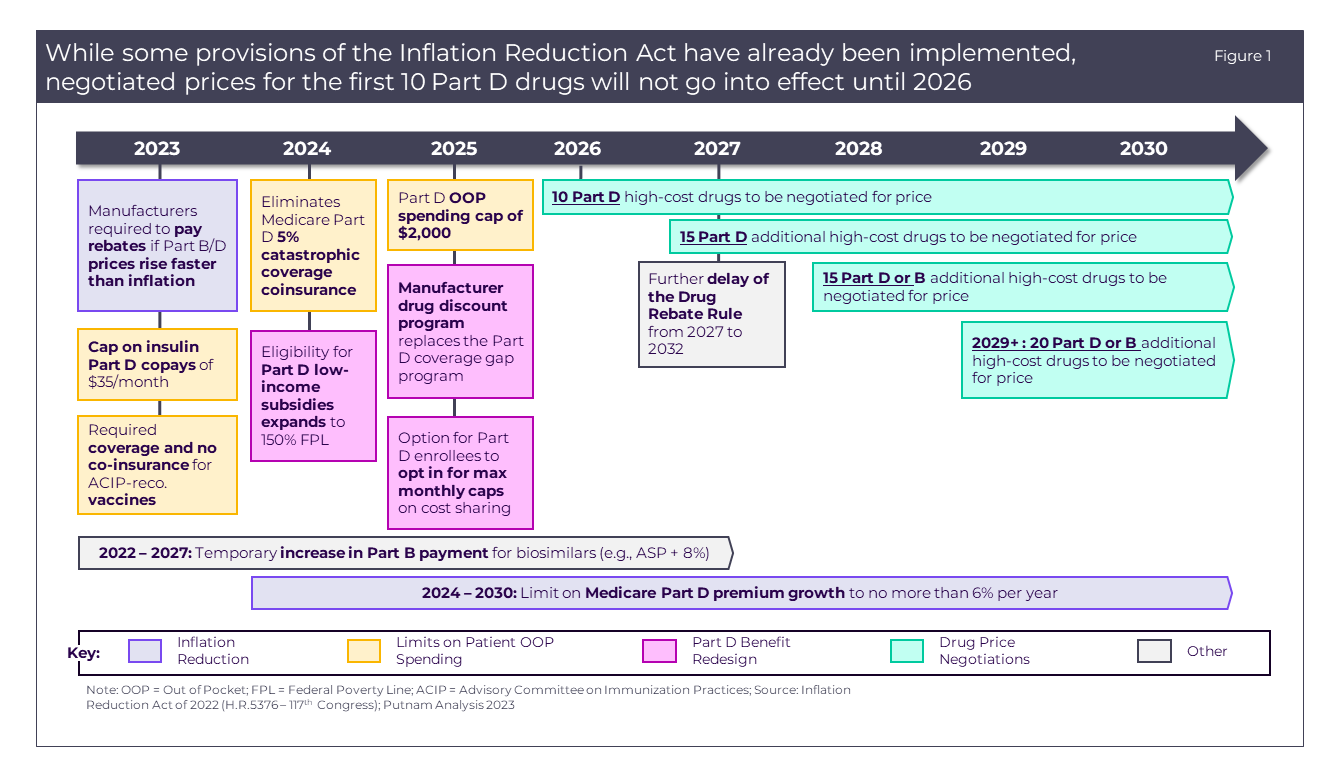

The Inflation Reduction Act aims to improve Medicare through expanding benefits, ostensibly lowering the cost of drugs, and stabilizing prescription drug premiums.2 The act is designed to reduce patient out-of-pocket (OOP) spending through changes to the Part D prescription drug benefits and pricing negotiations (detailed in Figure 1). The 4 major provisions were detailed in The Inflation Reduction Act: A Tale of Two Drugs.3 This paper also explained the impact that the IRA is likely to have on drugs, biologics, and vaccines over the coming years.

Turning our focus to the first phase of the Medicare Drug Pricing Negotiation reform, the first tranche of drugs selected for Medicare Price Negotiation will be announced by September 1, 2023, and will include 10 Part D drugs that top the list of Medicare expenditures over the preceding 12 months. The negotiations will establish a “maximum fair price” (MFP) that will take effect for Medicare beneficiaries starting in the 2026 plan year. In addition, enrollees’ access to these drugs may be expanded since Part D plans are required to cover all Part D drugs selected for negotiation.4

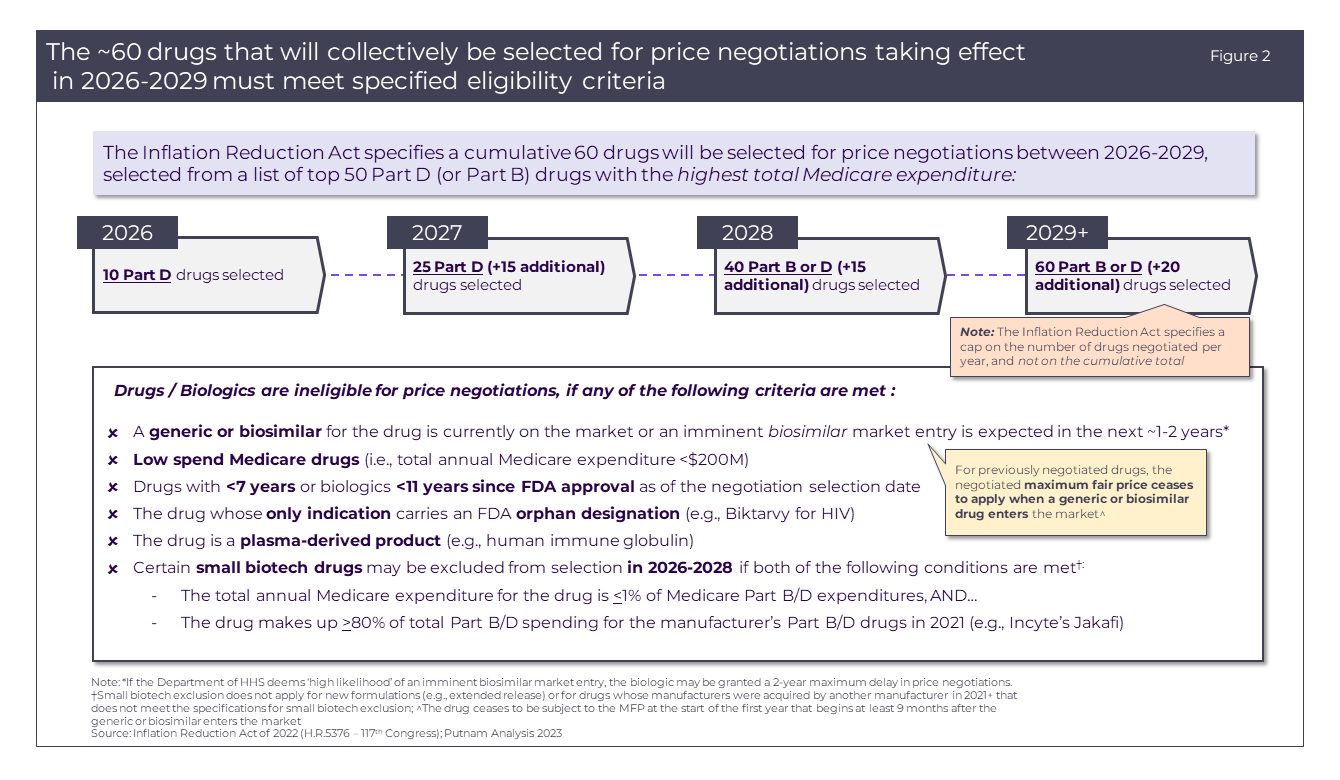

Exemptions and eligibility delays will be made based on a set list of criteria, allowing certain Part D drugs to avoid price negotiations for 2026. These criteria for exclusion (detailed in Figure 2) will be extended to any drug or biologic that meets one or more of the criteria.

Price negotiations

Likely targets for price negotiation in applicability year 2026

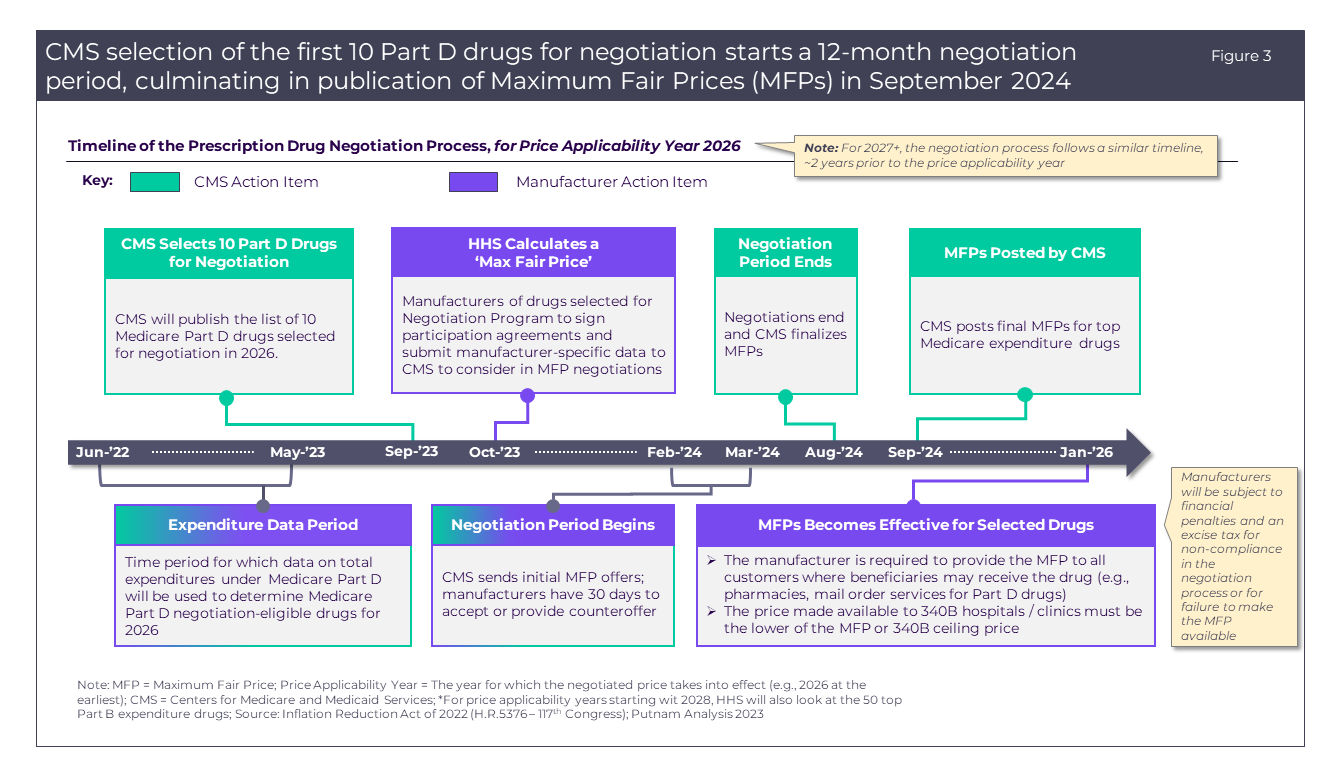

The U.S. Department of Health and Human Services is set to release the list of 10 drugs selected for the 2026 Medicare Price Negotiation Program by September 1, 2023. The negotiations will take place over the course of a year, and CMS will announce the MFP for each drug by September 1, 2024 (Figure 3).

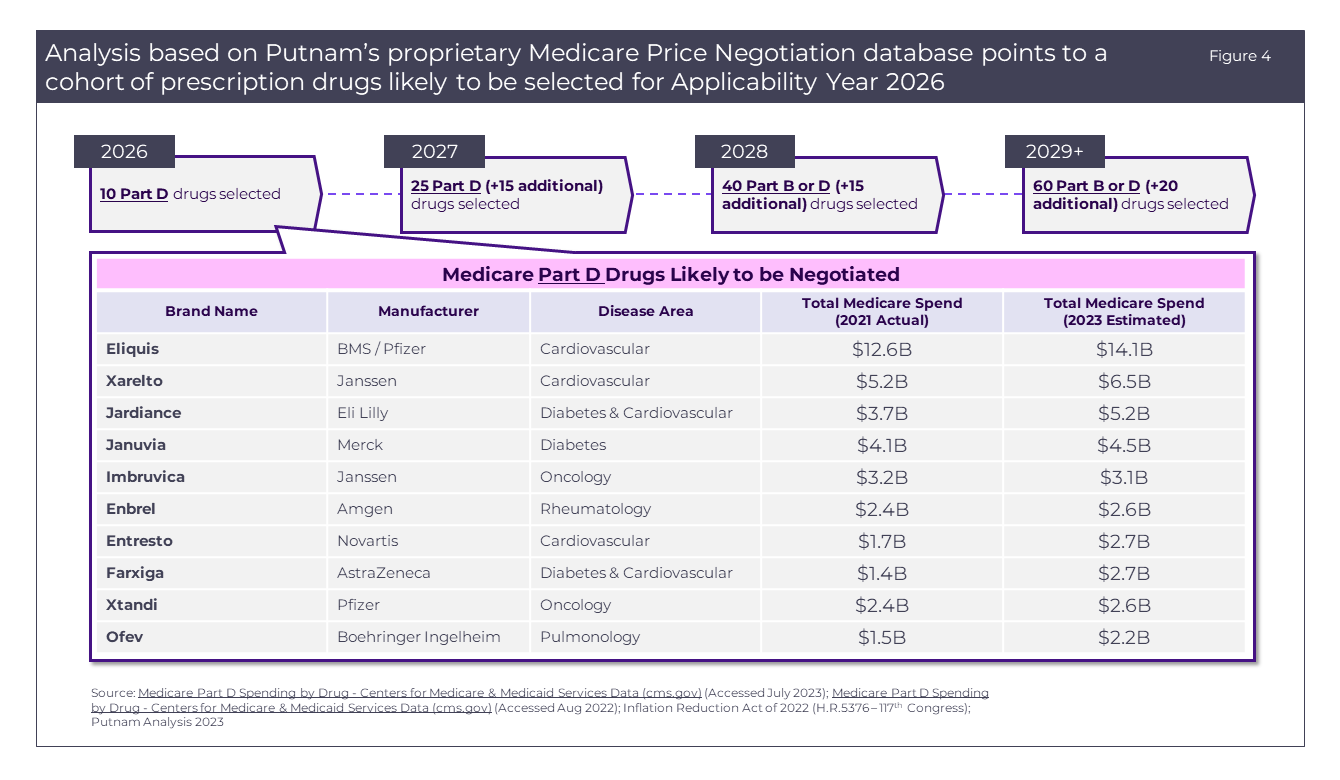

Based on estimated Medicare spending for the year of 2023 and accounting for the necessary exemptions, we anticipate the following 10 drugs (Figure 4) will be chosen for the 2026 price negotiations:

Eliquis*, Xarelto, Jardiance, Januvia, Imbruvica, Entresto, Farxiga, Enbrel, Xtandi, and Ofev.

*Generic approved by FDA but not commercially available due to BMS and Pfizer patent extension.5

The most recent full-year data on Medicare Part D expenditures comes from the Centers for Medicare and Medicaid Services in 2021.1 Expenditures for 2023 were estimated using data from annual and quarterly company earnings reports supplemented by projections from Evaluate Pharma, using either the expected compound annual growth rates (CAGR) or year-over-year (YoY) growth for each product. CMS data shows average annual growth rates for each product from 2017-2021; many of the above products’ annual Medicare expenditures have grown by an average of 6-7% per year. There were no products immediately below these 10 identified drugs in the list of total 2021 spending with a growth rate far exceeding the 6-7% range; therefore, we consider it unlikely that any will have risen sufficiently in the rankings of total expenditure by May 2023 to warrant selection for applicability year 2026. However, a number of drugs – including Pfizer’s Ibrance and AstraZeneca’s Symbicort – have seen sales plateau or decline slightly since 2021, resulting in our prediction that these medicines will narrowly avoid price negotiation for 2026 in favor of drugs with higher sales growth in the past 2 years.

Several drugs are expected to experience >$1B growth in Medicare spending from 2021 to present day, most often driven by indication expansions within the last 2 years (i.e., Eliquis, Xarelto, Jardiance, Entresto, Farxiga). Most notably, Farxiga is expected to almost double in Medicare Spend from 2021 to 2023 due to its 2021 indication expansion into chronic kidney disease (CKD)6 and 2023 indication expansion to reduce the risk of cardiovascular (CV) death, hospitalization for heart failure (hHF), and urgent heart failure (HF) visits in adults with HF.7

The 2026 negotiation is likely to disproportionately affect drugs used to treat diabetes and/or cardiovascular conditions (6 of 10 negotiated drugs), with oncology (2 of 10), pulmonology (1 of 10), and rheumatology (1 of 10) therapeutic areas impacted to a lesser extent. Most of the drugs targeted for price negotiations also hold a majority market share in their respective therapeutic areas due in part to broad indications and continued patent protections.5 These factors all account for the large disparity between these drugs and others in their class, decreasing market competition and allowing the manufacturers to dictate the prices of their drugs without robust competitive pressure.

Eliquis and Xarelto, for example, hold a majority market share in a crowded anticoagulant therapeutic area. Despite other therapies being available, Eliquis has seen steady growth each year since 2014, allowing it to retain control of over 50% of the anticoagulant market since 2018.8 In comparison, Pradaxa – another commonly used oral anticoagulant – realized Medicare sales of only $0.6B in 2021 (compared to Eliquis’s $12.B and Xarelto’s $5.2B).

The act of establishing a “maximum fair price” for these drugs will lower costs to the Medicare program for these prescription therapies prior to generic drugs or biosimilars becoming available. A tax will be levied against any manufacturer who does not comply with the negotiated price in an effort to keep name-brand therapies available to consumers. Beyond these 10 negotiated drugs, it is also likely that the net prices of non-negotiated, clinically similar drugs in the same therapeutic classes will decline for Medicare Advantage and standalone Medicare Part D plans as a result of pressure for manufacturers to provide rebates to these payer organizations to maintain favorable access in 2026 and beyond.

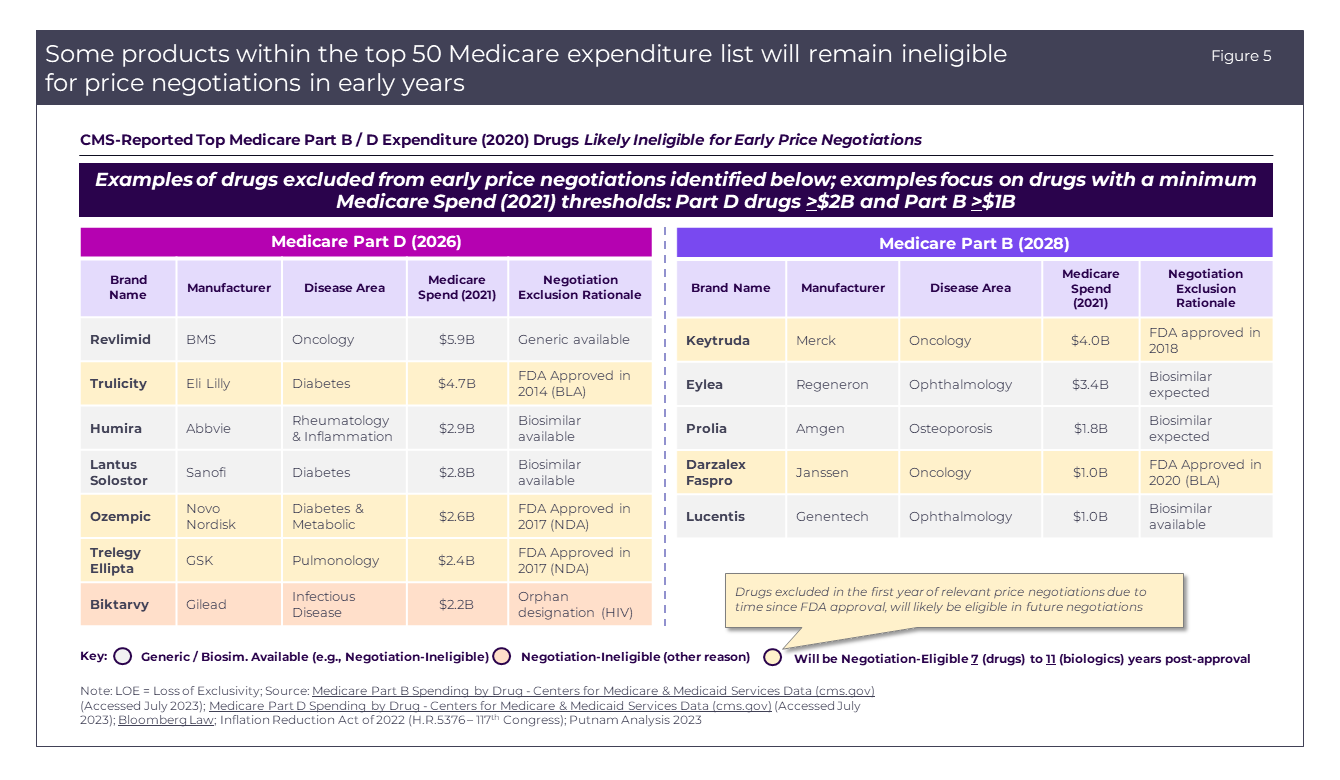

Several notable drugs that are currently top Medicare expenditures are excluded based on the eligibility criteria (Figure 5). The most common rationale for exclusion is that there are available generics or biosimilars available or the time since FDA approval is too recent to qualify for selection.

Future negotiations

The Price Negotiations will continue in 2027 with 15 more Part D drugs selected for negotiation. In 2028, there will be an expansion to include Part B and D therapeutics in the pricing negotiations (Figure 5), adding another 15 drugs, while each year 2029 and beyond will see negotiation of 20 Part B and D drugs (Figure 2). Over time, additional drugs and biologics will become eligible for selection based on changes in Medicare expenditures as well as time since FDA approval without generic or biosimilar competition.

Other considerations

PhRMA and other industry lawsuits

Congress’s efforts to dictate pricing for high-spend Medicare drugs have not come without expected pushback. In response to the passage of the IRA, multiple pharmaceutical companies have argued that various provisions of the Inflation Reduction Act of 2022 are unlawful, with at least four current lawsuits filed against the U.S. Government.

Merck and Bristol Myers-Squibb (BMS) both filed lawsuits stating that the drug pricing negotiations will hinder progress to develop groundbreaking treatments by eroding the profits that are used to fund these companies’ large R&D budgets.9,10 These suits claim that the Medicare Price Negotiation process is in violation of the First and Fifth Amendments: Violating the First by forcing companies to agree the MFP is “fair” and stating this is compelled speech and therefore not free; violating the Fifth by citing that companies have the right not to have private property taken for public use without just compensation. Similarly, a pharmaceutical trade group—The Pharmaceutical Research and Manufacturers of America (PhRMA)—filed a suit claiming the legislation violates the Fifth Amendment by “exempting key decisions from public input and insulating them from administrative or judicial review.”11,12 The U.S. Chamber of Commerce has also filed a suit against the Department of Health and Human Services and the Centers for Medicare and Medicaid Services, stating that the long-term implications of the pricing negotiations will ultimately cause harm to patients by hindering innovation of novel therapies.13

Projected impact

The IRA has quickly become a topical and impactful piece of legislation. While it strives to improve access to crucial therapies, it does not come without challenges and the possibility for myriad second-and third-order effects, both intentional and unintentional. As the government increasingly seeks to play a more active role in determining market prices for high-spend drugs, pharmaceutical companies are resisting these legislative and policy changes that fundamentally alter their operating principles and clinical development strategies. Both the government and pharmaceutical manufacturers argue that they operate with the intention of providing continued, high-quality care to as many patients as possible. With numerous suits emerging and over two years until MFP enforcement begins, we will continue to monitor the implications and outcomes of this legislation.

__________________________________________________________________________________________________________

For questions about the Inflation Reduction Act, Medicare Price Negotiation, and Putnam’s Value, Pricing, and Access (VPA) capabilities, please reach out to:

Scott Briggs

Principal, VPA Practice

Scott.Briggs@putassoc.com

Sources:

- Centers for Medicare & Medicaid Services Data. Medicare Part D Spending by Drug. [Online]. [Accessed July 2023].

- Inflation Reduction Act of 2022 (H.R.5376 – 117th Congress); Putnam Analysis 2023.

- Putnam Associates. The Inflation Reduction Act: A Tale of Two Drugs. 2022.

- KFF. FAQs About the Inflation Reduction Act’s Medicare Drug Price Negotiation Program. [Online]. [Accessed April 20, 2023].

- Bristol Myers Squibb. The Bristol Myers Squibb-Pfizer Alliance is Pleased with the Decision by the U.S. Court of Appeals for the Federal Circuit Upholding the Eliquis® Patents. [Online]. [Accessed September 3, 2021].

- AstraZeneca. Farxiga Approved in the US for the Treatment of Chronic Kidney Disease in Patients at Risk of Progression with and without Type-2 Diabetes (astrazeneca.com). [Online]. [Accessed April 30, 2021].

- AstraZeneca. Farxiga Extended in the US to Reduce Risk of Cardiovascular Death and Hospitalisation for Heart Failure to a Broader Range of Patients. [Online]. [Accessed May 9, 2023].

- Forbes. Can Eliquis Continue to Add $1 Billion in Annual Sales for Bristol-Myers Squibb? [Online]. [Accessed August 23, 2019].

- Reuters. Merck Sues US Government to Halt Medicare Drug Price Negotiation. [Online]. [Accessed June 6, 2023].

- Fierce Pharma. Bristol Myers Follows Merck’s Lead with Its Own Lawsuit Blasting IRA’s Medicare Negotiations. [Online]. [Accessed June 20, 2023].

- The Associated Press. Drugmaker Lobbying Group Sues over Plan to Negotiate Medicare Drug Prices. [Online]. [Accessed June 21, 2023].

- Reuters. Pharmaceutical Rade Group Sues US over Medicare Drug Price Negotiation Plans. [Online]. [Accessed June 21, 2023].

- U.S. Chamber of Commerce. Why We’re Suing HHS and CMS to Challenge Illegal Price Controls. [Online]. [Accessed June 9, 2023].

Jump to a slide with the slide dots.

Eric Auger

Eric Auger

Value, pricing and access practice: Where are we investing our energy to achieve product launch excellence?

The drug development pipeline has evolved from primary care to specialty and now advances deeper into exquisitely targeted therapies.

Read moreAsset medical lifecycle plan

US and EU regulatory agencies provided the client with new guidance on generating supportive evidence for the proposed launch indication and future.

Read more