Putnam & PHMR

Much has been made about the framework for Medicare price negotiations included in the recently passed Inflation Reduction Act of 2022, but this is just one of multiple provisions implemented in four phases that impact healthcare access, spending, and delivery in the U.S. While certain outcomes of the Act – like the reduction in out-of-pocket drug costs for Medicare beneficiaries and expectation of higher list prices for new drug launches – are clear and consistent across brands, others are likely to have vastly different effects across products and manufacturer portfolios. Putnam is developing tools and insights to help manufacturers of innovative drugs assess and realize opportunities and mitigate risks to their brands created by the Inflation Reduction Act of 2022.

What the act says

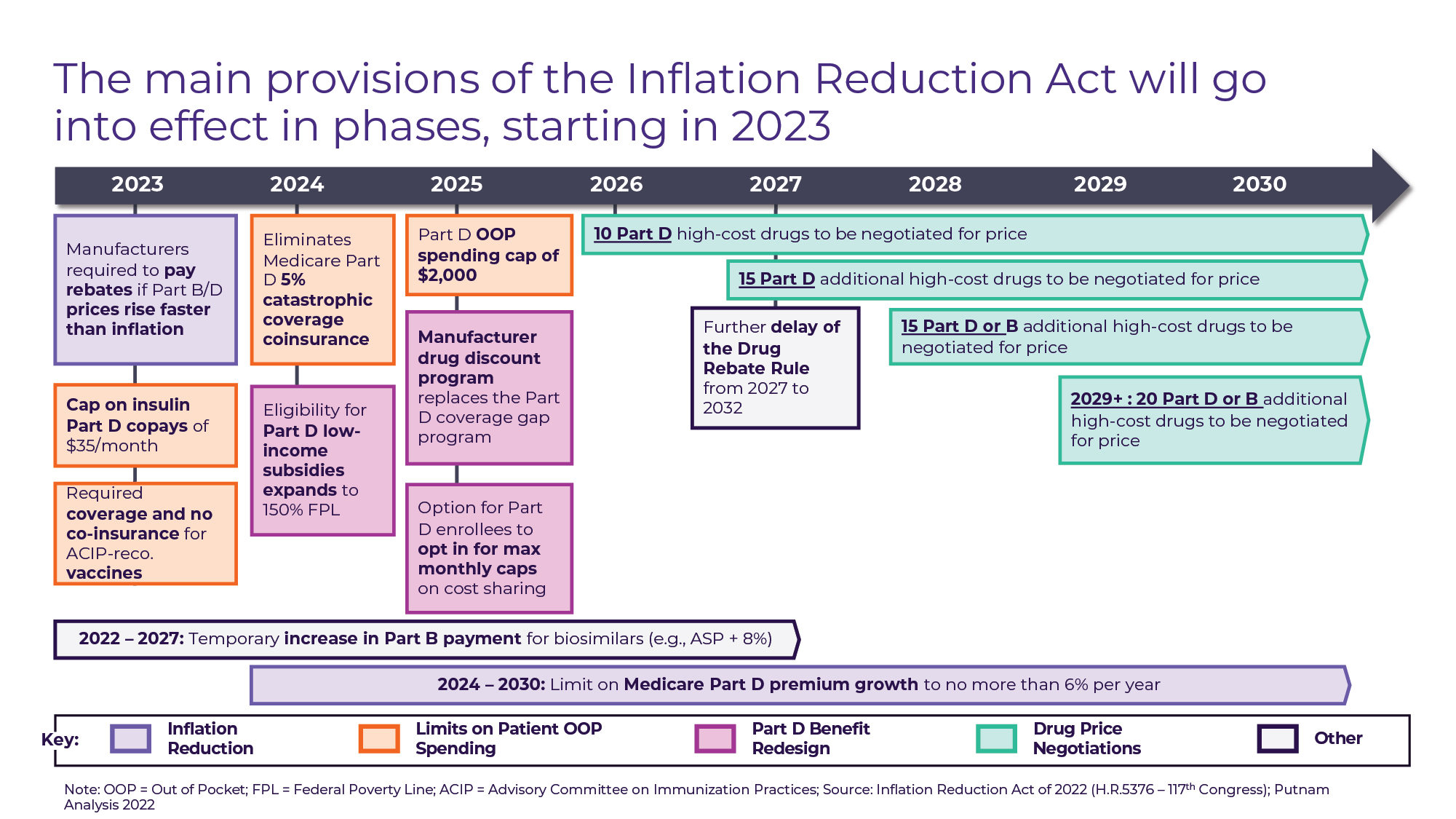

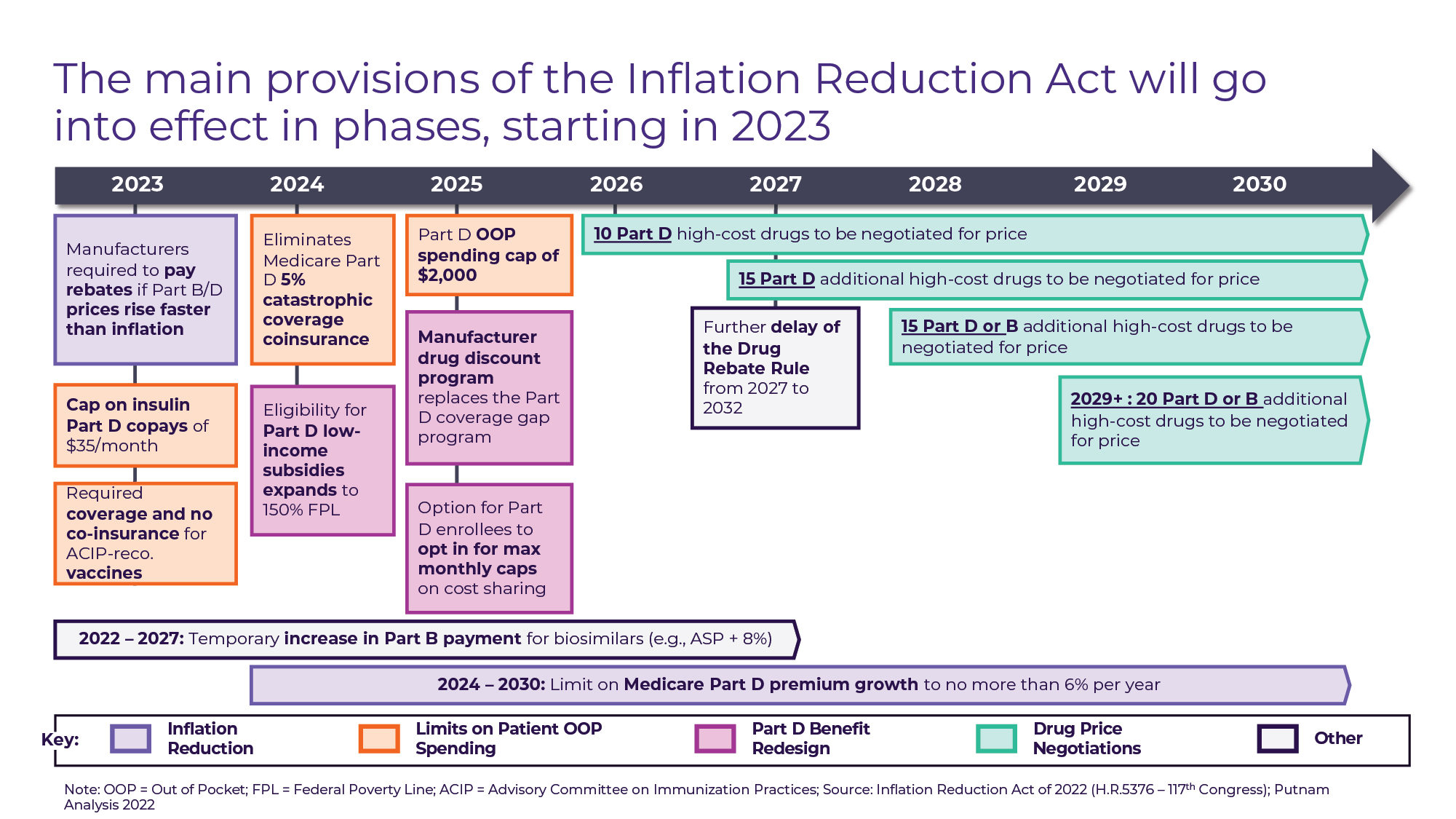

Figure A

The text of the Act’s Prescription Drug Pricing Reform spans 95 pages and over 30,000 words, but its primary features can be categorized into 4 sets of provisions (see Figure A) that go into effect in phases:

• “Inflation Reduction” (2023+): Beginning in October 2022 for Part B drugs and April 2023 for Part D Drugs, drug manufacturers will be required to pay rebates to CMS for price increases on most drugs that exceed the rate of inflation (CPI-U). This provision expands upon the similarly structured Medicaid CPI penalty in effect since 1990. The Act also limits Medicare Part D premium growth to 6% per year from 2024 through 2030.

• Patient out-of-pocket (OOP) spending limits (2023-2025): Currently, there is no out-of-pocket cost ceiling for Medicare Part D beneficiaries, with the patient responsibly progressively declining from 100% until the $505 deductible is met, to 25% during the initial coverage and coverage gap period, to 5% once patients reach the catastrophic coverage limit (out-of-pocket spend exceeding $7,050 for 2022). The Act includes a series of provisions designed to reduce out-of-pocket spending for Medicare Part D enrollees in 3 phases. In 2023, patient cost-sharing will be eliminated for all vaccines covered under Medicare Part D – creating parity with vaccines covered under Part B like pneumococcal and influenza – and patient cost-sharing for insulin will be capped at $35 for a one-month supply. In 2024, the 5% coinsurance for Part D beneficiaries who reach catastrophic coverage based on out-of-pocket drug spend will be eliminated. One year later, an annual Part D out-of-pocket maximum of $2,000 will take effect.

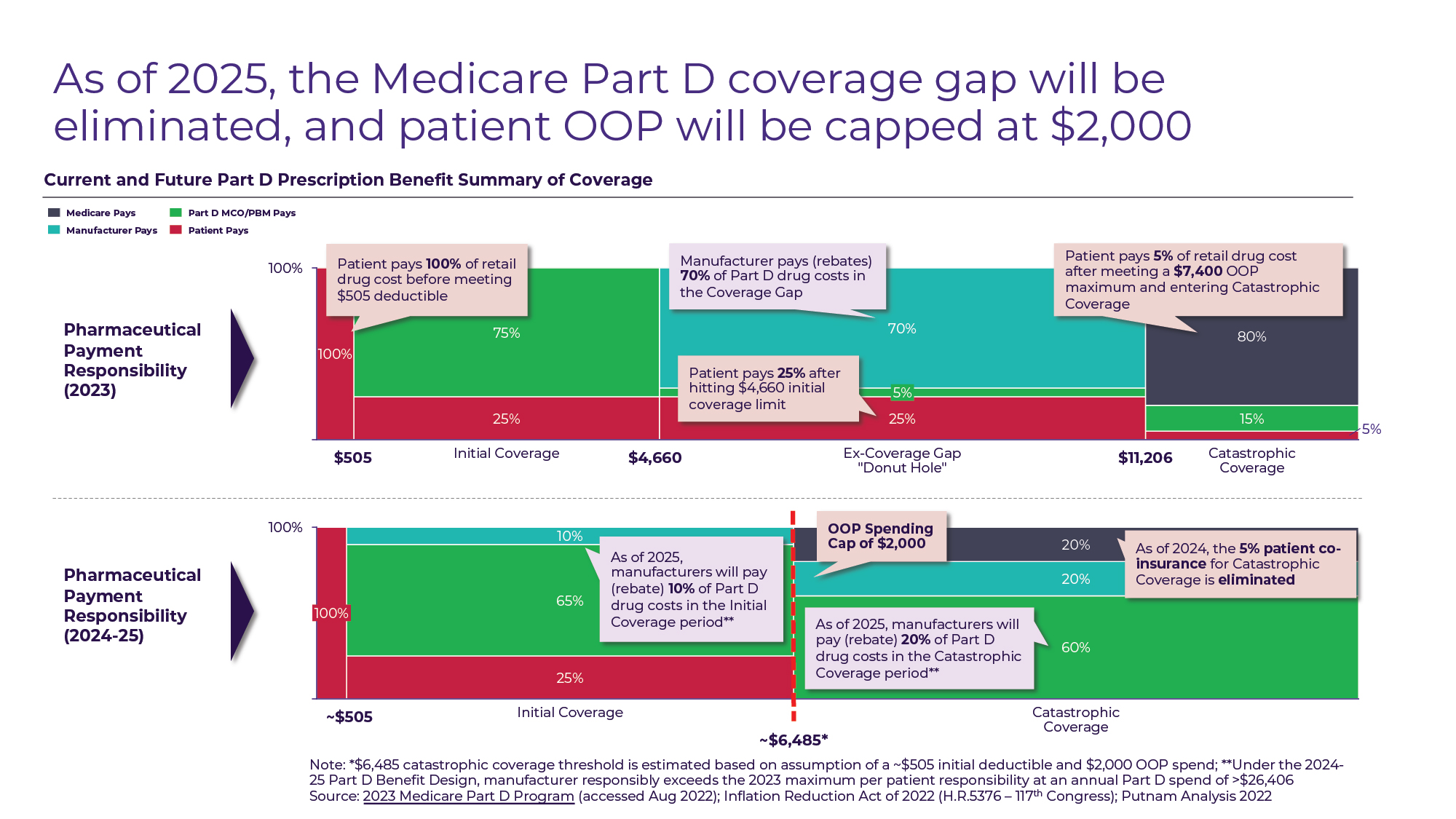

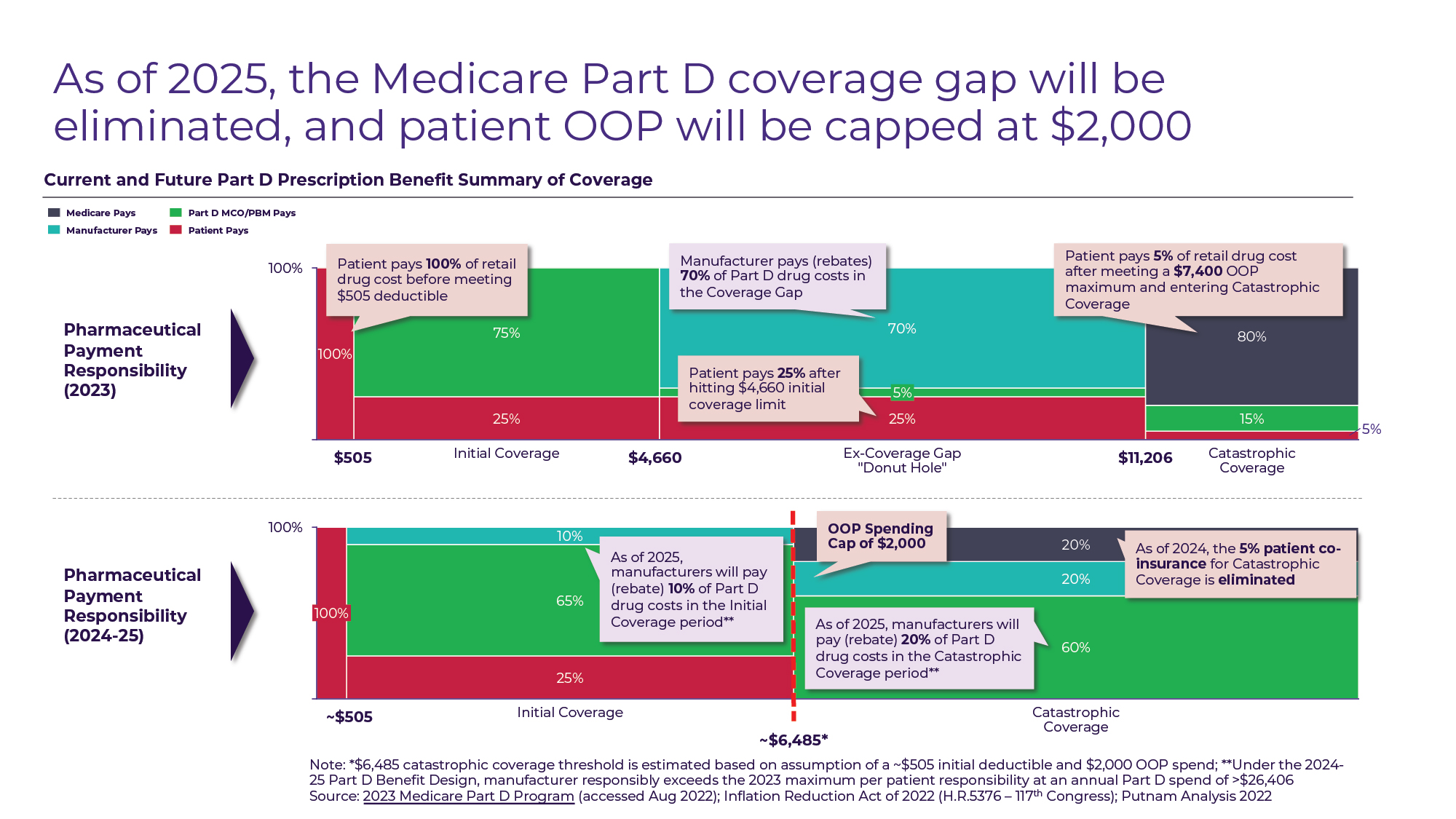

• Medicare Part D benefit redesign (2025): The patient OOP cost reductions that take place in 2024 and 2025 are part of a broader redesign of the Part D benefit that changes not only patient responsibility for drug costs, but also Medicare plan and manufacturer responsibility. Currently, drug manufacturers are required to “discount” drugs (in the form of Medicare plan rebates) by 70% for Part D beneficiaries who are in the coverage gap (drug spending between $4,660 and $11,206). In 2025, the coverage gap will be eliminated, and instead manufacturers will be required to discount drugs for Part D beneficiaries by 10% during the initial coverage period and by 20% during the catastrophic coverage period (see Figure B).

Figure B

• Medicare drug price negotiation (2026 and Beyond): The Act’s most publicized provision grants the Secretary of Health & Human Services (HHS) the ability to “negotiate” discounts on behalf of Medicare for a subset of drugs. The law mandates minimum discounts for negotiated drugs based on time since approval, with a minimum 25% discount off the non-federal Average Manufacturer Price (AMP) for drugs less than 12 years since approval at the time of negotiation up to a minimum 60% discount for drugs greater than 16 years since approval. In 2024, HHS will publish a list of the top 50 Part D drugs without generic or biosimilar competition by total Medicare expenditure and select 10 drugs from the list for negotiation. The negotiated “maximum fair price” (MFP) will take effect for Medicare beneficiaries starting in the 2026 plan year. In 2027, an additional 15 Part D drugs will be negotiated, and starting in 2028 Part B drugs will be eligible for negotiation as well, with an additional 15 Part B or Part D drugs selected. In 2029 and beyond, 20 Part B or Part D drugs will be selected for negotiation each year. Although negotiated drugs are likely to span most drug classes and all therapeutic areas, the drugs eligible for negotiation are subject to a litany of exclusions and exemptions including (1) drugs less than 7 years since approval for small molecules and less than 11 years since approval for biologics, (2) drugs with “imminent” generic or biosimilar competition “expected,” (3) drugs whose only indication carries an orphan designation, (4) plasma-derived products, and (5) certain “small biotech” drugs for the 2026-2028 negotiation years.

What the act does

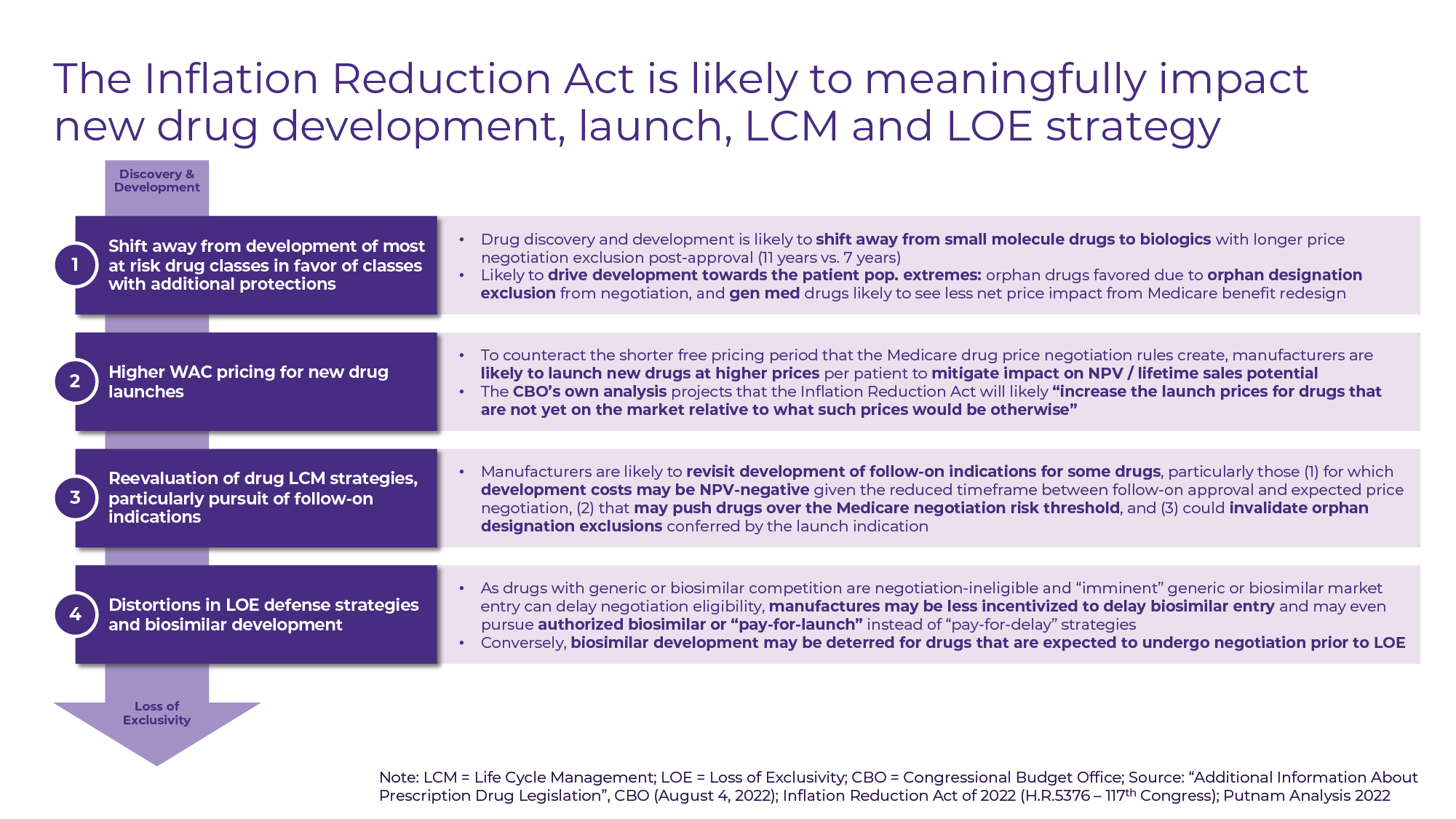

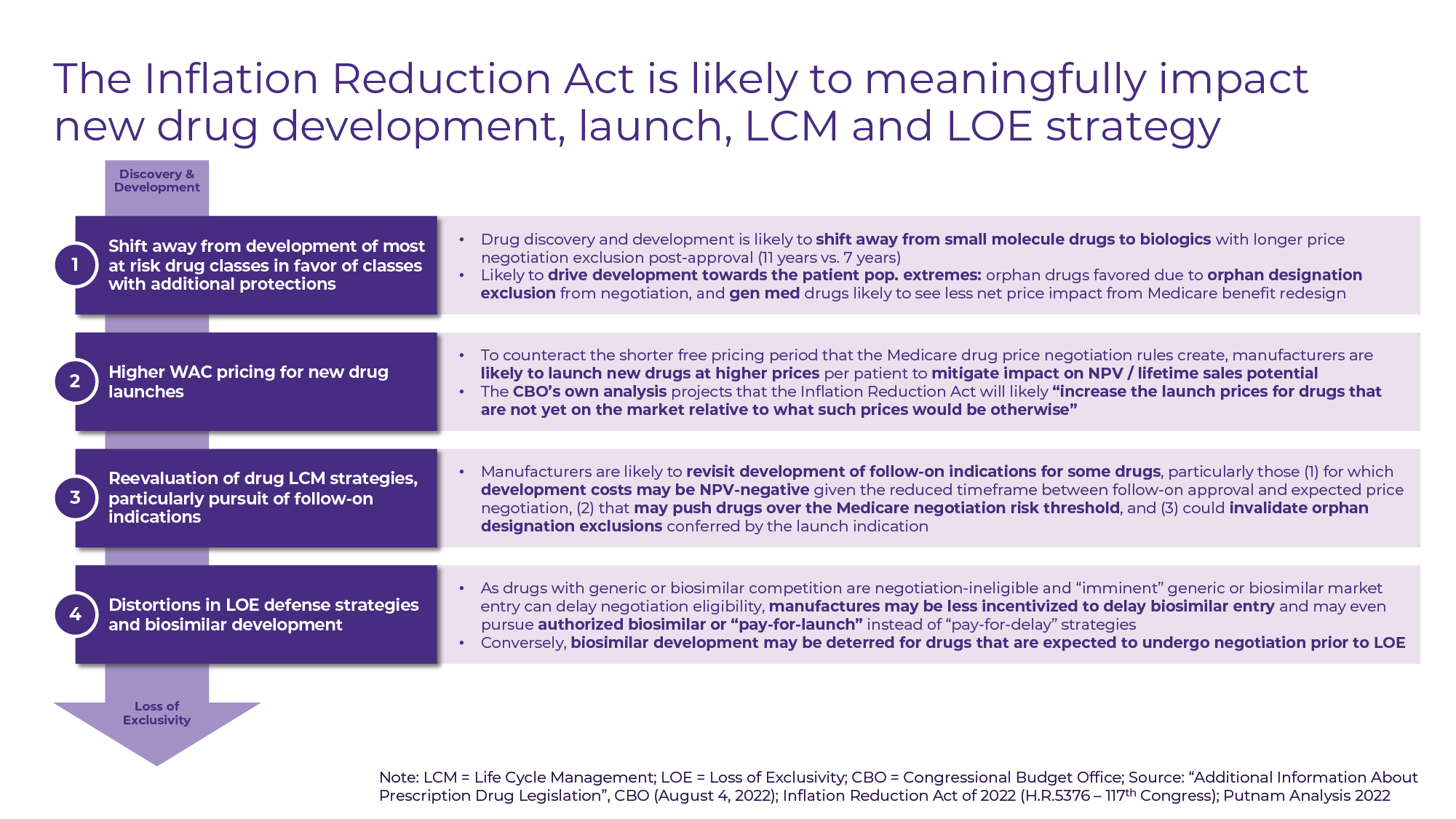

Beyond the direct results of the Inflation Reduction Act – including limiting price increases for medicines post-approval and reducing out-of-pocket drug spending for Medicare enrollees – there are a broader set of indirect effects that are likely to touch every drug manufacturer and every product from pre-clinical development to late lifecycle.

Most observers, including the Congressional Budget Office, predict that by reducing manufacturers’ free-pricing timeframe following approval, the Act is likely to “increase the launch prices for drugs that are not yet on the market relative to what such prices would be otherwise” as manufacturers seek to maximize sales potential over a shorter time horizon1. Higher launch pricing will allow manufacturers to both “front load” price increases to avoid inflation penalty rebates and offset the effect of mandatory Medicare discounts post-price negotiation.

There is further concern that manufacturers may begin to second-guess investment in follow-on indications if the associated development costs are projected to be NPV-negative given the reduced timeframe between follow-on approval and expected price negotiation or if additional indications risk invalidating orphan designation exclusions from price negotiation. Distortions in the still nascent biosimilars market are likely as manufacturers of reference products may seek to employ novel licensing and patent agreements (including licensing rights to “authorized biosimilars”) to avoid price negotiation, while some biosimilar manufacturers will have to consider the effects of price negotiations for reference products on their ability to recoup development costs.

New drug discovery and development priorities are likely to shift as investors and manufacturers take stock of the drug classes likely to be impacted the most by the IRA. We may see a reinforcement of the shift away from small molecule drugs in favor of biologics with longer price negotiation exclusion periods (11 years vs. 7 years for small molecules) post-approval. The increase in proportion of R&D expenditures targeting orphan indications that has been observed since the passage of the Orphan Drug Act is likely to accelerate in response to the orphan designation exemption from Medicare price negotiation (see Figure C).

As the various overlapping and compounding provisions of the Inflation Reduction Act are dissected, it is becoming clear that no two therapeutic areas – and indeed no two drugs, as the example below illustrates – are impacted in quite the same way.

Figure C

A tale of two drugs

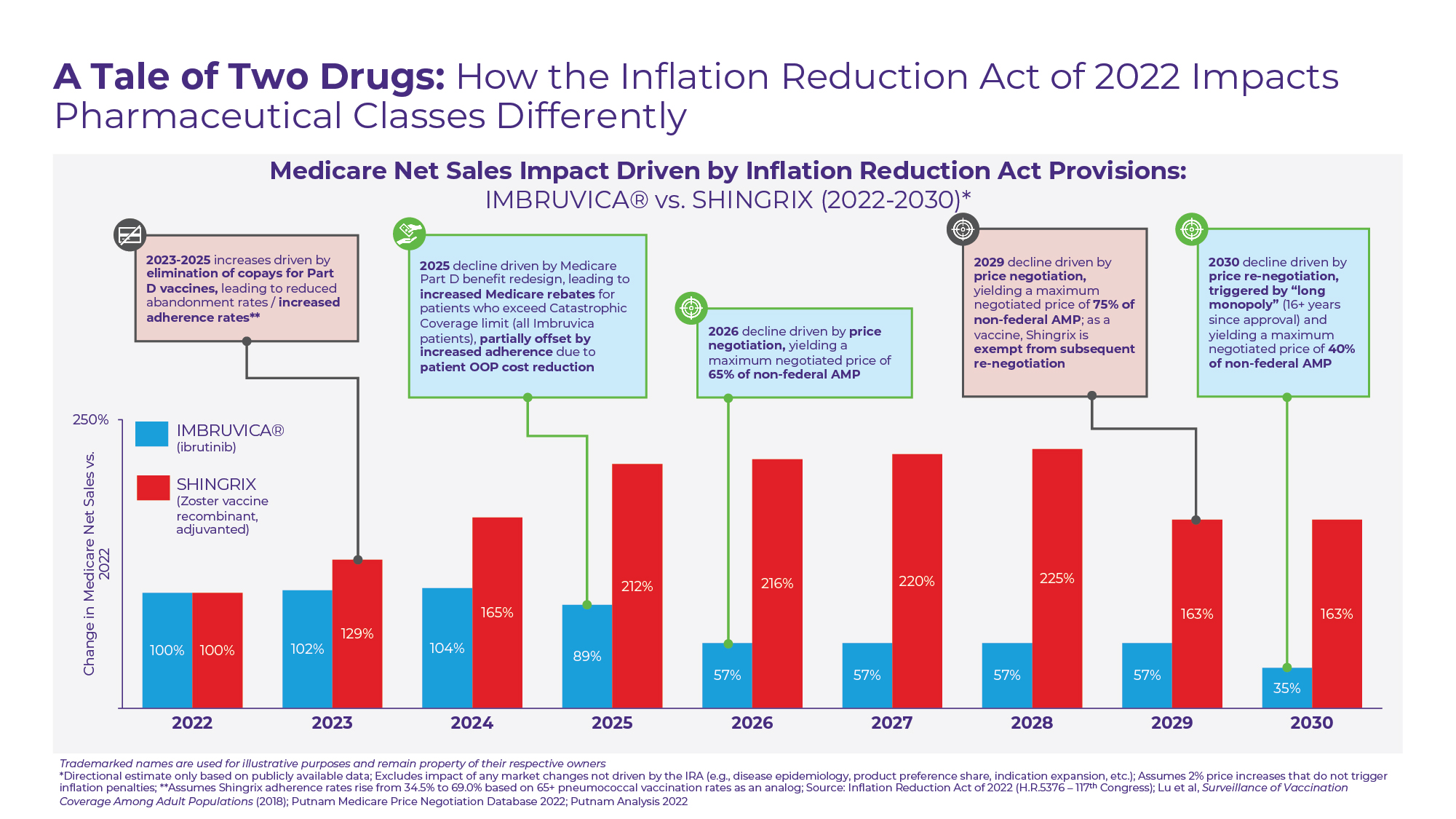

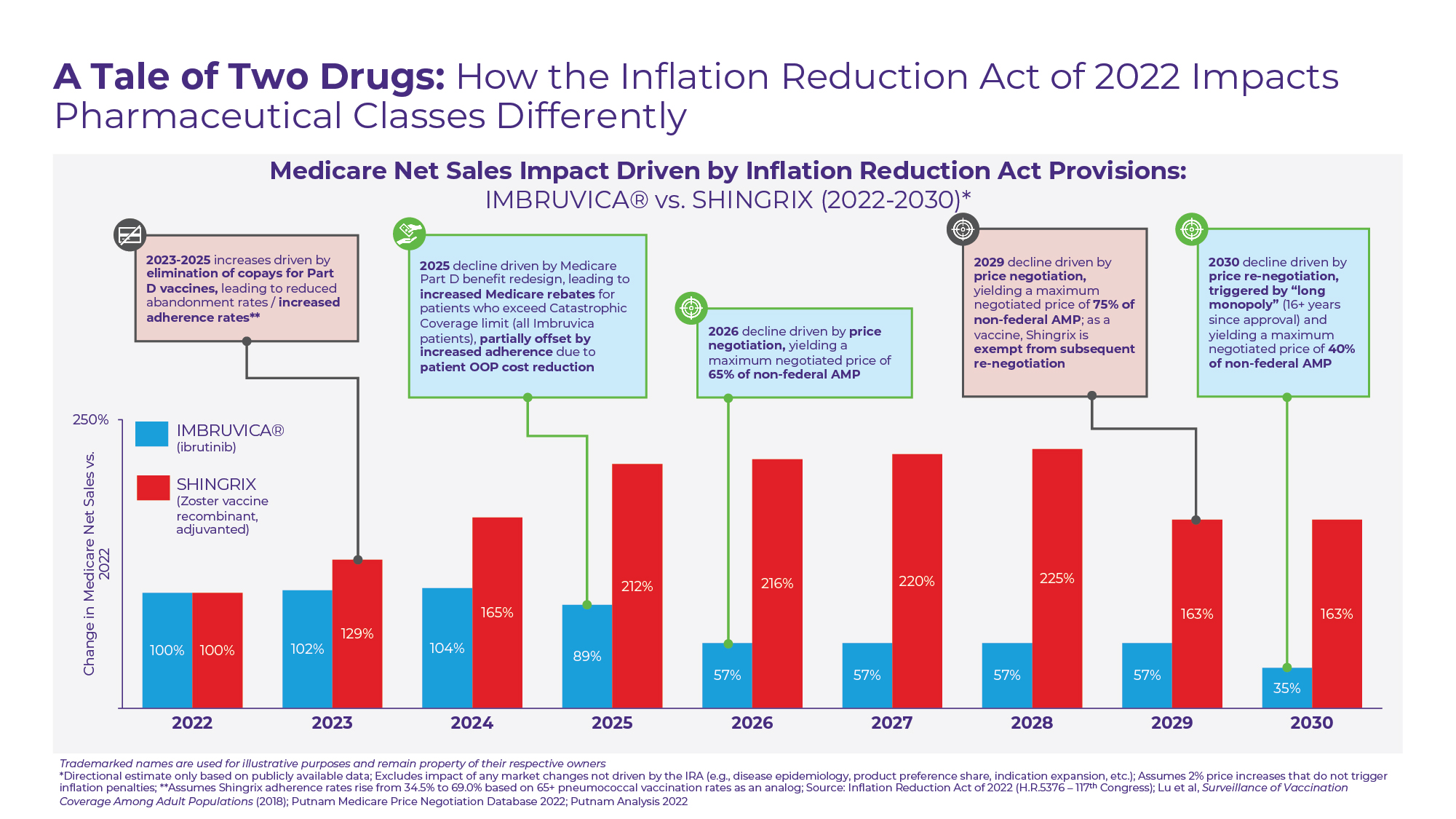

To demonstrate the wide variance in potential effects of the Inflation Reduction Act, Putnam has charted the potential paths of two high Medicare spend pharmaceutical products through 2030 (see Figure D).

Figure D

The first – Imbruvica – is an oral, small molecule drug used to treat a variety of cancers including Chronic Lymphocytic Leukemia (CLL), Small Lymphocytic Leukemia (SLL), and Mantle Cell Lymphoma (MCL). As one of the Top 10 drugs by Part D expenditure in 2020 and without generic competition expected until 2032 at the earliest, Imbruvica has been identified as a likely 2026 Medicare price negotiation target.

However, even before Imbruvica’s “maximum fair price” goes into effect, the drug’s Medicare net sales are likely to be reduced by the Medicare benefit redesign. At an annual cost of ~$195,000 per year ($~16,250 per month), patients treated with Imbruvica would be expected to hit Medicare’s catastrophic coverage limit within the first month of the year2. Under the current Medicare benefit design, the per patient manufacturer rebate responsibility is capped at 70% of drug costs within the coverage gap, which equates to $4,582 or less than 3% of Imbruvica’s wholesale acquisition cost (WAC). In 2025 under the new Medicare benefit design, the per patient manufacturer rebate responsibility for high-cost drugs like Imbruvica will increase significantly, approaching 20% of WAC. Although this increase in required rebates is likely to be paired with a modest increase in adherence rates driven by lower patient OOP costs, we hypothesize the combined effect on net sales in 2025 to be negative. In 2026, this impact is likely to be compounded by price negotiation yielding a minimum discount of ~35%. In 2030, Imbruvica will be subject to price re-negotiation by nature of its “long monopoly” status, yielding additional price concessions.

Excluding changes in disease epidemiology or treatment patterns, we therefore estimate that the Inflation Reduction Act’s provisions could collectively reduce 2030 Medicare net sales for Imbruvica by almost two-thirds as compared to the drug’s 2022 baseline.

In contrast, the IRA may cause an increase in Medicare net sales for GSK’s Shingrix – the sole vaccine currently available in the US recommended for prevention of shingles (herpes zoster) in adults 50 years and older. As a vaccine covered under Medicare Part D, most Medicare beneficiaries are currently charged a co-pay when receiving Shingrix, unlike Part B vaccines that have no patient cost-sharing responsibility.

In part due to the high abandonment rates that come with these co-pays, shingles vaccination rates lag many other vaccines recommended for older adults. Vaccination coverage was last recorded by the CDC at 34.5%, exactly half the rate of pneumococcal vaccine coverage in a similar age group3. The removal of patient cost-sharing for Part D vaccines including Shingrix in 2023 has the potential to boost vaccination rates in this population and drive higher Medicare sales. Furthermore, as a result of the much lower per patient cost of Shingrix ($172 per dose for a 2-dose series) as compared to Imbruvica, the Medicare benefit redesign is not anticipated to materially change GSK’s Medicare rebate obligation.

Based on initial FDA approval date, Shingrix is a likely price negotiation candidate for 2029, with the negotiation for a “short monopoly” drug required to yield a minimum discount of ~25%. Despite the introduction of a maximum fair price, we project Shingrix will achieve Medicare net sales in 2030 that exceed the product’s 2022 baseline. As a vaccine, Shingrix is both precluded from any subsequent price re-negotiation under the IRA and insulated from biosimilar competition, providing greater long-term price certainty.

Projecting the impact

As our brief tale of two drugs demonstrates, the full impact of the Inflation Reduction Act on the biopharmaceutical industry will manifest over many years and will be felt to varying degrees based on each manufacturer’s unique portfolio of medicines. Quantifying this impact for any one drug requires rigorous analysis, financial modeling, and scenario planning.

To help our clients prepare, Putnam is developing a proprietary Medicare Price Negotiation Database to identify likely candidates for negotiation in 2026 and beyond, which reflects a triangulation of datapoints from sales forecasts, patent expiration and generic/biosimilar entry timelines, orphan drug designation listings, and other sources (see Figure E). Complementing our financial modeling capabilities, market research expertise, and over 30 years of biopharmaceutical Value, Pricing, and Access (VPA) strategy experience, we have the tools to support our clients in navigating the new regulatory landscape that the Inflation Reduction Act introduces.

For questions about the Inflation Reduction Act and Putnam’s Value, Pricing, and Access (VPA) capabilities, please reach out to our authors:

Scott Briggs

Principal, VPA Practice

Scott.Briggs@www.www.putassoc.com

Alexander Busch, PhD

Partner, VPA Practice

Alex.Busch@www.www.putassoc.com

Download PDF.

References:

- Swagel PL. Letter from the Congressional Budget Office Director to the Honorable Jason Smith Re: Additional Information About Prescription Drug Legislation. Assessed August 4, 2022.

- Imbruvica annual cost estimate based on the recommended dose for CLL and SLL patients of 420mg per day and a WAC price of $14,956.08 for a 28-day supply, per Medi-Span® PriceRx®. Accessed September 27, 2022.

- Lu PJ, Hung MC, Srivastav A, et al. Surveillance of vaccination coverage among adult populations — United States, 2018. Surveillance Summaries, 2021;70(3):1–26. https://www.cdc.gov/mmwr/volumes/70/ss/ss7003a1.htm.