Simplify to amplify: “Declutter” your current Customer Engagement approach to maximize value

Karan Raje / 28 February 2024

Karan Raje / 28 February 2024Research Contributors: Sam Coates, Consultant & Tamara Kailas, Senior Associate Consultant

This is a preview of our latest whitepaper. Be sure to download the full piece below.

Customers have evolved; how has pharma’s customer engagement model kept up with the pace of change?

More integrated. More data-led. More digitally connected. More time-pressed. More resource-constrained. Multiple environmental changes – technological, medical, and financial – have continued to drive a shift in the way pharma customers* operate and connect within the wider healthcare ecosystem. While we do not want to labor on trends that have been extensively covered in many publications, we do want to emphasize the increasing level of consolidation and interconnectivity across the healthcare value chain: such trends require and will continue to require a profound shift in the way pharma engages with integrated customers to maximize the magnitude and speed of product adoption. Multiple actors and organizations have emerged over the last few years: Integrated Delivery Networks (IDNs) in the US – whose market is forecast to double by 20301, Integrated Care Systems (ICS) in

the UK, multiple regional integrated care initiatives across European markets and a general trend towards consolidation of healthcare providers and hospitals, further fueled by a more active role of private equity investment2.

In just the past three years, the number of physicians employed by hospitals or corporate entities increased by 30%3. In the US, this consolidation can be attributed to the passage of the Affordable Care Act (driven by rising health care costs), COVID-19 disruption on independent physician groups’ traditional ways of working, as well as increasing treatment complexity necessitating more centralized and specialized care4. Similar trends have been observed across European markets with NHS trusts consolidating in the UK5, a third of hospitals having undergone mergers in France between 2010-2017, and over 50% of hospitals in Germany being part of a wider healthcare network6.

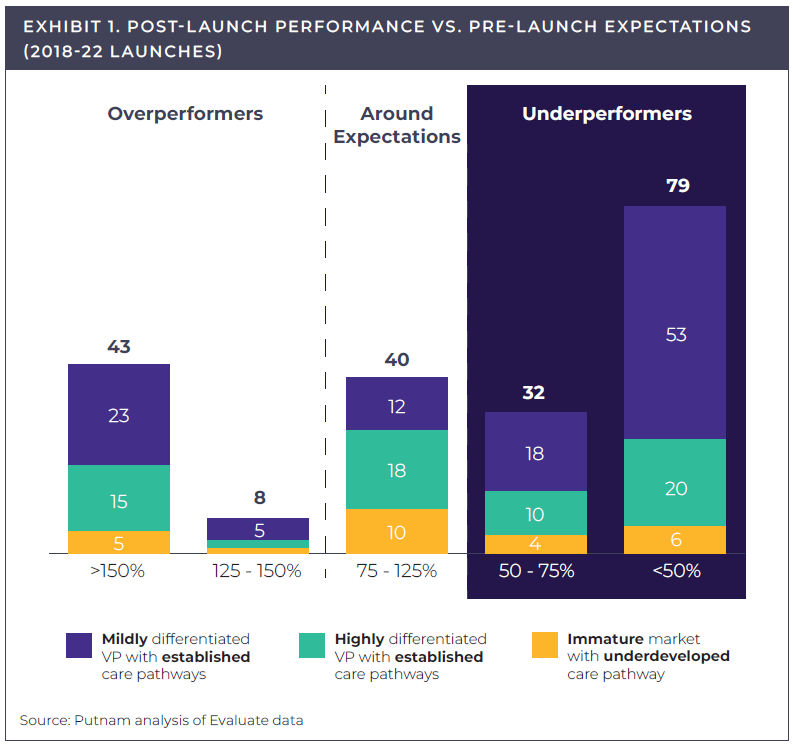

While numerous initiatives – e.g., new frontline models, care pathway optimization collaboration – have been rolled out by pharma companies to tackle this change, multiple factors have hindered the overall performance: underdeveloped capabilities, sub-optimal investment, lack of sufficient sponsorship and, in many cases, gaps in fully grasping the nuances of these new customers and how to engage with them. This lag in performance is corroborated by our recent launch excellence study. In an analysis of just over 200 product launches since 2018, we found that more than 50% of launches continue to ‘underperform’ (consistent with the previous analysis7 released in October 2022), failing to meet analysts’ pre-launch expectations of first-year revenues; a finding consistent across therapeutic areas (see Exhibit 1).

*In this context, we define pharma customers holistically, from clinicians, payers, patients, and other relevant healthcare stakeholders.

Jump to a slide with the slide dots.

Navigating IRA Negotiations: Lessons from Round One and Strategies for Future Success.

Explore how CMS set 2024 drug MFPs under the IRA—insights, data drivers & pharma strategies for future Medicare negotiations.

Read more Mariah Hanley

Mariah Hanley

US vaccines trends and strategies for manufacturers

Discover insights into the evolving US vaccine landscape, trends, and strategic imperatives for successful novel vaccine launches. Download now!

Read more Mariah Hanley

Mariah Hanley

Recent Trends in Rare Diseases

Putnam experts share observations on recent global trends in the rare disease space and recommend strategies to maximize opportunities.

Read more