Preparing for the effects of the IRA on payer contracting

In addition to lowering costs for CMS and patients, the Inflation Reduction Act (IRA) is likely to prompt a range of second-order effects on the pharmaceutical industry. Much of the recent dialogue around the unintended consequences of the IRA has focused on the potential impact to R&D investment, but an issue that has received much less attention to date is the potential impact on payer contracting dynamics. The IRA is likely to substantially increase pressure for manufacturers to provide rebates to Medicare Advantage Part D plans (MAPDs), standalone Medicare Part D plans (PDPs), and Commercial payers, holding the potential to erode gross-to-net percentages across manufacturers’ portfolios.

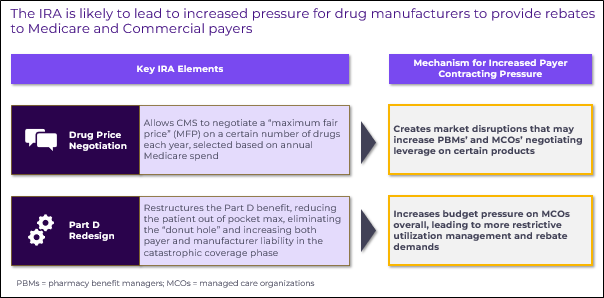

Drug price negotiation and Part D redesign, two central aspects of the IRA, will both impact payer rebating dynamics in separate ways:

- Drug price negotiation will create market disruptions that increase pharmacy benefit managers’ (PBMs) and managed care organizations’ (MCOs) negotiating leverage for certain types of products

- Part D redesign will increase budget pressure on MCOs, which they may seek to mitigate by enacting more restrictive utilization management and demanding greater rebates wherever possible

Both of these pressures, while most directly impacting the Medicare book of business, can have spillover impacts on Commercial payer contracting. With this in mind, pharmaceutical companies should be prepared to execute rigorous and recurring tradeoff analytics to support decision-making around payer contracting requests. These companies may ultimately be forced to make the difficult decision to forgo optimal access with certain payers for the sake of preserving gross-to-net.

Figure 1

Impact of drug price negotiation on payer contracting demands

Drug Price Negotiation will directly reduce the costs Medicare incurs for CMS-selected products down to a negotiated Maximum Fair Price (MFP). While on the surface this is a clear win for payers, it will disrupt the delicate equilibrium of contracting and access dynamics that exists today across many therapeutic areas.

This disruption has potential to impact manufacturers’ gross-to-net percentages for both CMS-negotiated and non-negotiated products. For CMS-negotiated products, the mandatory price reduction will upset discretionary rebate streams which are important to the financial health of both MCOs and PBMs. For competitors to CMS-negotiated products, the presence of a much lower-cost product in the market basket may prompt payer demands for additional rebates. Figure 2 below and its accompanying details summarize how these disruptions may span both Medicare and Commercial books of business.

Figure 2

CMS-Negotiated products, Medicare book of business: Payers may seek to extract additional concessions beyond MFP to avoid full loss of valuable rebate streams

Due to the structure of the Part D benefit, rebates are more valuable to MCOs than an upfront price reduction down to the MFP. This is because the rebates are disproportionally retained by the MCO rather than shared back with CMS. Additionally, PBMs retain a portion of rebates and rely on these rebate streams for their solvency. Therefore, Medicare payers will have a strong incentive to extract rebates on top of MFP pricing, especially for products that were heavily rebated prior to CMS negotiation.

This presents an important risk for manufacturers of CMS-negotiated products, as MFP pricing is already highly likely to be lower than today’s net price. Moreover, while the IRA statute requires Part D and Medicare Advantage formularies to include CMS-negotiated products, it doesn’t specify what level of access they must have. For example, a CMS-negotiated product could still be disadvantaged relative to a competitor via tiering or a step edits while satisfying the IRA’s access requirements, so long as it’s on-formulary. This fact enables payers to threaten disadvantaged access for CMS-negotiated products if additional rebates are not provided on top of MFP pricing.

Competitors to CMS-Negotiated products, Medicare book of business: Payers gain leverage in rebate negotiations if a competitor is selected for CMS price negotiation and thus has significantly lower net cost

If a selected product’s MFP is significantly lower than the current payer net cost of its competitors, there is a meaningful risk that payers will disadvantage the competitor unless rebates are offered to bring net pricing down within range of the selected product’s MFP. This is a risk even in classes with minimal contracting today, and it is compounded by the budget pressure imposed by Part D redesign (discussed below).

CMS-Negotiated products, Commercial book of business: MFP visibility provides Commercial payers with leverage in negotiations

2026 MFPs for the first round of CMS-negotiated products will be published on September 1st, 2024, and explanations will be made publicly available on March 1st, 2025. The visibility of MFP will not only make fully transparent the forward-looking Medicare net price of the selected products, but it will also shed light on the level of Medicare rebates provided historically, since the MFP ceiling is rooted in mean Part D net price in 2022 (assuming that price falls below the statutorily defined ceiling price). Commercial payers may use this information as leverage to extract additional rebates from manufacturers.

Competitors to CMS-Negotiated products, Medicare book of business: If MFP visibility translates to greater commercial rebates for CMS-negotiated products, their competitors may also experience commercial rebate pressure

This is a logical extension of the effect described immediately above: if the visibility of MFP for CMS-negotiated products translates to a lower Commercial net price, then that product’s competitors could also face pressure for increased rebates within the Commercial book of business.

Impact of Part D Redesign on payer contracting demands

The impact of Part D Redesign on payer contracting demands is straightforward in its implications for pharmaceutical manufacturers. The premise is simply that MCOs will face increased budget pressure across their organizations and will respond by enacting more restrictive utilization management wherever possible.

Under the redesigned Part D benefit, the MCO’s liability in the catastrophic coverage phase will be 60% beginning in 2025, compared to 15% today. The threshold at which catastrophic coverage begins will also be lower – down from approximately $11,000 in total prescription drug spend to approximately $6,500. While these adjustments in payer exposure will result in adjusted plan bid amounts, they will increase payers’ “skin in the game” and may compress margins. By restricting utilization management as much as possible, payers can 1) rein in costs by curtailing access to expensive drugs and biologics and 2) extract additional rebates from manufacturers to counterbalance budget pressures.

This dynamic is likely to have the most expansive effect in Medicare Advantage plans, where payers have an ability to offset the increased budget pressure through management of both the Pharmacy and Medical benefits; however, it is also likely to impact Part D plans, and potentially even Commercial plans operated by the same parent organizations, as they look to counterbalance budget pressures on their Medicare books of business.

Increased pressure from PDPs and MAPDs is likely to be felt across drug classes and therapeutic areas. Yet the ability for payers to actually pull through increased utilization management or rebate concessions will vary based on a several key factors including:

- Level of spend

- Disease severity

- Presence of therapeutic alternatives

Pharmaceutical manufacturers need to develop frameworks for strategically managing and responding to what is likely to be a deluge of payer “asks”.

Preparing for increased payer rebate pressure

Considering the dynamics described above, pharmaceutical manufacturers are likely to face numerous threats of restrictive utilization management from both Medicare and Commercial payers in the coming years. This may take the form of payers bidding out therapeutic classes that have historically not been subject to payer contracting, or revisiting their management of classes that are already contracted. Deciding whether to cede to each individual payer management threat by offering increased rebates will require careful consideration and analysis.

With the first round of CMS price negotiations well underway and Part D redesign taking full effect next year, pharmaceutical companies have already begun to prepare by ramping up their resourcing for contract analytics and adjusting forecasts to account for increased rebates and utilization management. Having a robust decision-making framework and a set of tailor-made analytical tools in place can help ensure that companies take the optimal strategic path when faced with difficult payer contracting decisions.

Sources:

- Inflation Reduction Act of 2022 (H.R.5376 – 117th Congress)

- Medicare Drug Price Negotiation Program: Revised Guidance, Implementation of Sections 1191 – 1198 of the Social Security Act for Initial Price Applicability Year 2026

- Juliette Cubanski and Tricia Neuman. Published: Apr 20, 2023. Changes to medicare part D in 2024 and 2025 under the Inflation Reduction Act and how enrollees will benefit. KFF. – Link

Jump to a slide with the slide dots.

Lori Klein, PharmD

Lori Klein, PharmD

How Medical Affairs is Embracing AI to Drive Precision and Impact

Explore how AI is reshaping Medical Affairs, driving precision, enhancing patient outcomes, and unlocking new opportunities for biopharma in 2025

Read more Rudiger Papsch

Rudiger Papsch

MAPS EMEA 2025: Driving Transformation and Excellence in Medical Affairs

Explore how MAPS EMEA 2025 redefined Medical Affairs - patient-centricity, AI, evidence generation & launch excellence take center stage

Read more Jo Ann Saitta

Jo Ann Saitta

Why AI Needs Humans: The Critical Thinking Advantage in Pharmaceutical Commercialization

AI speeds pharma insights, but human experts turn them into action. ClarityNav blends AI power with strategic, real-world expertise.

Read more