Integrating market access considerations into biopharmaceutical asset investment decisions: Common pain points and best practices

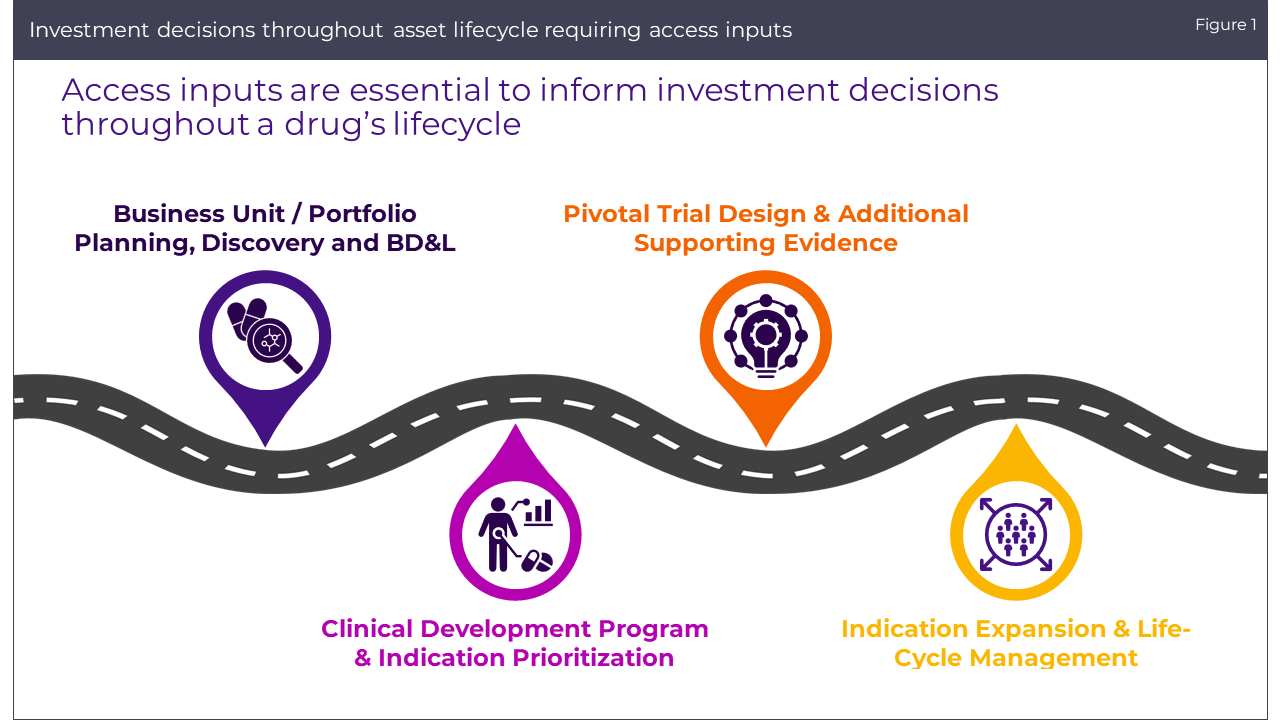

The biopharmaceutical industry operates at the intersection of health innovation and market viability, where the significance of integrating market access insights into investment decisions cannot be overstated. From the inception of a new therapy to clinical development and pivotal trial designs, market access analyses provide a critical lens through which the commercial trajectory of a product is evaluated. This approach ensures not only the development of clinically effective products but also their market success by aligning them with payer expectations and healthcare systems’ needs. As the industry faces growing complexities, the ability to navigate these with informed access integration becomes imperative for reaching patients effectively.

In our work with clients, we have experienced several common organizational pain points in integrating market access into investment decision-making, and we have identified and replicated best practices for mitigating these challenges.

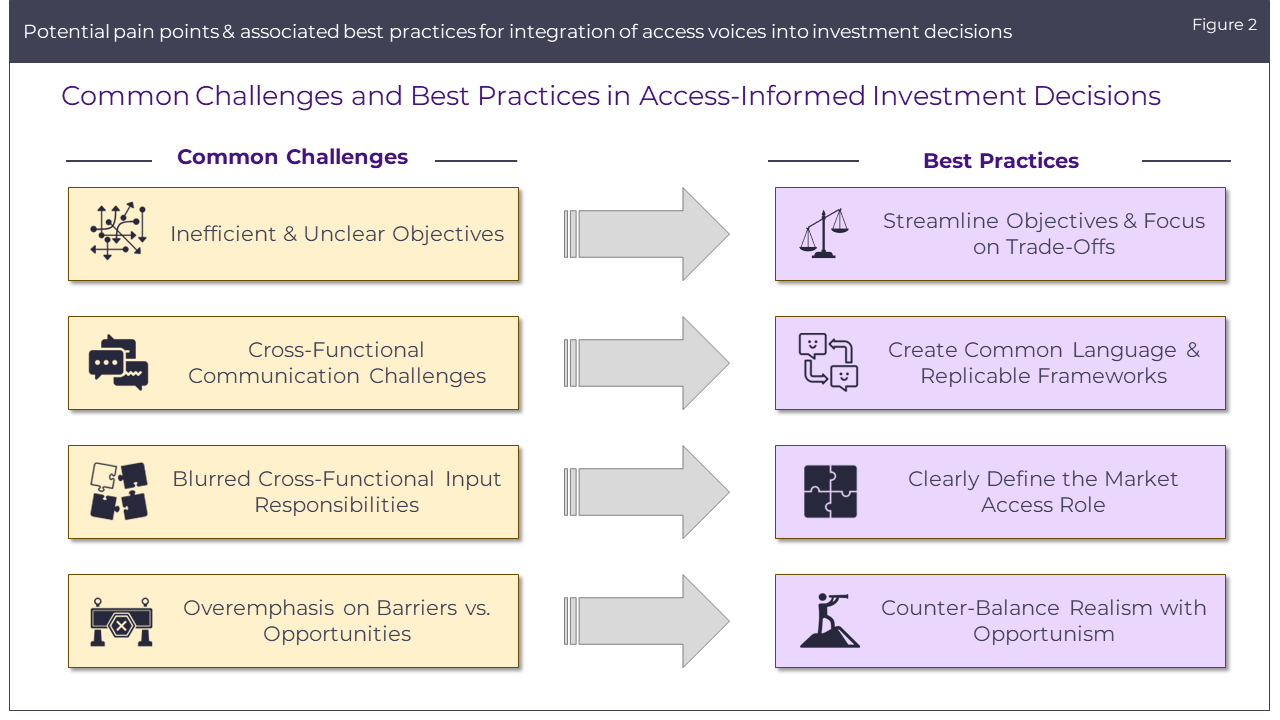

Common Pain Points in Integrating Access Voices into Investment Decisions

The path to integrating market access considerations into pharmaceutical asset investment decisions is fraught with challenges that can hinder effective decision-making:

Inefficient and unclear objectives:

Market access teams may find themselves navigating without a clear direction, working towards objectives that are not only vague but also inconsistently applied across different stages of the process. The focus often shifts between assessing static Target Product Profiles (TPPs) and trying to develop a singular “reimbursable” TPP, without considering the dynamic nature of market access environments and the multitude of potential pathways a drug development process could take.

In contrast, clients who seek to focus on early identification of risk and rewards trade-offs associated with different investment options, rather than static assessment or development of a TPP, are much more likely to facilitate dynamic decision-making that adapts with evolving information.

Cross-functional communication challenges:

Effective collaboration is hindered by the absence of a shared language and understanding between cross-functional teams. This gap in communication can lead to key market access considerations being lost in translation among teams unfamiliar with access-specific terminologies and concepts.

Successful integration of access considerations requires establishing a common language and replicable frameworks to bridge this divide, facilitating clearer insights and mutual understanding that facilitate the integration of market access insights and enhance decision-making confidence.

Blurred cross-functional input responsibilities:

Successful, informed investment decision-making requires a variety of critical, cross-functional inputs. There is often ambiguity surrounding the roles and responsibilities of different teams involved in providing inputs to the decision-making process. This lack of clarity can result in duplicated and mis-aligned efforts and a general inefficiency in progressing towards strategic goals. Clarifying these roles and establishing clear lines of responsibility and coordination among teams can streamline processes and ensure that market access considerations are effectively integrated and leveraged.

Overemphasis on barriers vs. opportunities:

Market access teams are frequently tasked with assessing the challenges and barriers to achieving patient access at a price that supports the investment hypothesis, leading to a predominant focus on identifying and communicating the hurdles that may be faced in gaining market entry, sustainable pricing, and patient accessibility. This focus can tend to overshadow the vigorous investigation of pathways to maximize the pricing and access opportunity. Encouraging a balanced perspective that equally weighs the realistic identification of barriers and the creative and opportunistic exploration of potential positive drivers can yield a more balanced view of an asset’s prospects and an early stimulus to developing a holistic and proactive pricing and market access strategy.

Best Practices to address key pain points

Each of these pain points underscores best practice opportunities for market access leaders to frame and organize their role and maximize their influence and impact on asset investment decision-making across the asset lifecycle. By implementing these best practices, leaders can ensure that the market access lens is applied rigorously and improve the efficiency and effectiveness of their organization’s investment decision processes, ultimately benefiting both the business and the patients it serves.

Key best practices include the following:

Streamlining Objectives to Focus on Trade-Offs:

- Profile a range of options and scenarios: Instead of focusing on a singular TPP or trying to identify a singular “reimbursable” TPP, systematically consider a variety of potential paths, their implications and feasibility.

- Identify risks and reward trade-offs: Leverage the systematic scenario approach to identify trade-offs to inform decision-making under uncertainty, encouraging a dynamic approach to decision-making that adapts as new information becomes available.

Creating Common Language and Replicable Frameworks:

- Establish replicable frameworks: Develop frameworks that educate cross-functional stakeholders and provide a consistent and replicable approach they can digest.

- Use simple and intuitive language: Ensure that the frameworks and language used facilitate mutual understanding and productive dialogue, remembering non-access stakeholders are often unfamiliar with market access vocabulary, that key market access terms often have multiple meanings dependent upon stakeholder context.

Clearly Defining the Market Access Role:

- Clarify roles, responsibilities, and decision-making authority: Ensure every team knows their specific contributions to the process, and very clearly identify the boundaries of input that the market access team will provide.

- Ensure cohesive vision: Clearly define the specifics of dependencies and intersectionality between market access inputs with assumptions and inputs that are the responsibility of other cross-functional teams.

Counter-Balancing Realism with Opportunism:

- Adopt a solution-oriented mindset: Balance the roles of realist and optimist, looking beyond known or forecasted challenges to identify pathways and opportunities for pricing and access optimization.

Conclusion

Integrating pricing and access functions into asset investment decisions is crucial for developing pharmaceutical assets that are not only innovative, but that are accessible to appropriate patients and realize an adequate return on investment. By recognizing and addressing the common pain points through established best practices, organizations can pave the way for innovations to achieve their true potential, reaching those who need them most, and providing a return that supports and encourages further innovation and progress. As the healthcare landscape continues to evolve, and biopharmaceutical innovations grow more complex and more narrowly targeted, the strategic and timely integration of market access considerations into investment decision-making will only grow in importance. It will be upon market access leaders to ensure efficient and effective engagement to maximize their impact in the decision-making process.

Jump to a slide with the slide dots.

Rudiger Papsch

Rudiger Papsch

MAPS EMEA 2025: Driving Transformation and Excellence in Medical Affairs

Explore how MAPS EMEA 2025 redefined Medical Affairs - patient-centricity, AI, evidence generation & launch excellence take center stage

Read more Jo Ann Saitta

Jo Ann Saitta

Why AI Needs Humans: The Critical Thinking Advantage in Pharmaceutical Commercialization

AI speeds pharma insights, but human experts turn them into action. ClarityNav blends AI power with strategic, real-world expertise.

Read more Radosław Skowron

Radosław Skowron

Acceptance of Artificial Intelligence in Evidence and Dossier Developments by HTA bodies: Challenges and Opportunities

AI is transforming Health Technology Assessment, but trust, transparency, and clear HTA guidance are key to broader acceptance.

Read more