The world of healthcare is evolving rapidly, and an exciting frontier is the realm of Digital Therapeutics (DTx). These innovative solutions, designed to work independently or in concert with pharmaceuticals, devices, or other therapies, have the potential to transform the way we manage and treat health conditions. Despite their immense promise, these solutions have struggled to gain widespread use.

We engaged with Medical Affairs leaders across large pharmaceutical and niche DTx companies to understand how they can play a pivotal role in this journey to improve adoption of DTx and make them accessible to patients. We also engaged with payers and key access decision-makers across multiple regions, including the United States, the United Kingdom, Germany, France, Australia, and Japan. This global perspective enabled us to gain a deeper understanding of the primary factors limiting access and uptake, as well as what changes are necessary to overcome these obstacles1.

In this blog post, we will scrutinize the significant hurdles faced by DTx, dissect the contributing factors, propose essential changes for their resolution, and shed light on how Medical Affairs can be a crucial contributor to this endeavor.

A decade of growth: The rapid rise of DTx

DTx represents a dynamic field with approximately 100 globally approved products reshaping healthcare. The number of newly registered DTx clinical trials annually has almost quadrupled in the last decade2. The post-pandemic surge in development and clinical trials underscore the industry’s vibrancy. Predominantly targeting mental health and central nervous system (CNS) indications, these solutions have gained support from pharmaceutical companies, including Pfizer, Janssen, Novartis, BMS, AbbVie, Roche, and Sanofi.

Facing the present: Unpacking DTx challenges

The challenge facing DTx extends beyond the theoretical and touches upon the stark realities of the healthcare industry. Once viewed as a high-growth frontier of the healthcare market, adoption of DTx has remained rather low in the post-COVID world.

Lack of payer coverage has been cited as the primary obstacle among industry circles, and recent developments within certain companies have underscored the impact of this issue. The bankruptcy of Pear Therapeutics, known for its reSET and reSET-O DTx products, has been a significant turning point in the DTx landscape3. Once considered a pioneer in the field, Pear Therapeutics’ financial turmoil underscores the complexities of navigating the healthcare industry. Akili’s workforce reduction and recent shift towards an over-the-counter (OTC) model adds another layer to the challenges DTx companies face, as they must adapt and innovate to stay afloat4.

While reimbursement is the major issue in most geographies, uptake has also been slow for reimbursed products, especially in markets like Germany, where ~50 DTx products are reimbursed5. These developments emphasize the need for a critical evaluation of the challenges faced by DTx and the fundamental reasons behind them.

Decoding the adoption dilemma: A closer look

Medical Affairs leaders and payers highlight several factors contributing to unfavorable adoption of DTx:

- Lack of robust efficacy outcomes: One of the primary challenges is the absence of robust efficacy outcomes data. Without clear evidence demonstrating the effectiveness of DTx, healthcare professionals and institutions are understandably cautious about embracing these digital therapies.

- Poorly designed clinical trials: The absence of well-designed and meticulously executed clinical trials emerges as a significant hurdle. Payers observe that numerous DTx products lack the support of data derived from randomized clinical trials with sufficiently robust sample sizes. This limitation can result in inconclusive findings, thereby impeding the acceptance and credibility of DTx within the healthcare provider community.

- Unclear evidence on cost-effectiveness: Another contributing factor is the lack of clear cost-effectiveness evidence. In an industry where cost-efficiency is paramount, the absence of compelling data demonstrating the economic advantages of DTx is seen as a substantial barrier. This is seen as a bigger factor in countries like the UK and JP compared to the US.

- Limited awareness and lack of perceived value: Beyond the data-driven concerns, there is a general lack of awareness and a gap in the perceived value of DTx. Healthcare professionals and patients alike need to be educated about the potential benefits these therapies could offer.

- Difficulty integrating DTx into existing clinical workflows and/or additional HCP workload: Echoing physician sentiments, this factor is highlighted particularly by Medical Affairs leaders. They note that current DTx products are not seamlessly integrated into established clinical processes, and that, coupled with existing HCP workloads, creates a substantial impediment to achieving broader DTx adoption.

Charting a path to success: Overcoming adoption challenges

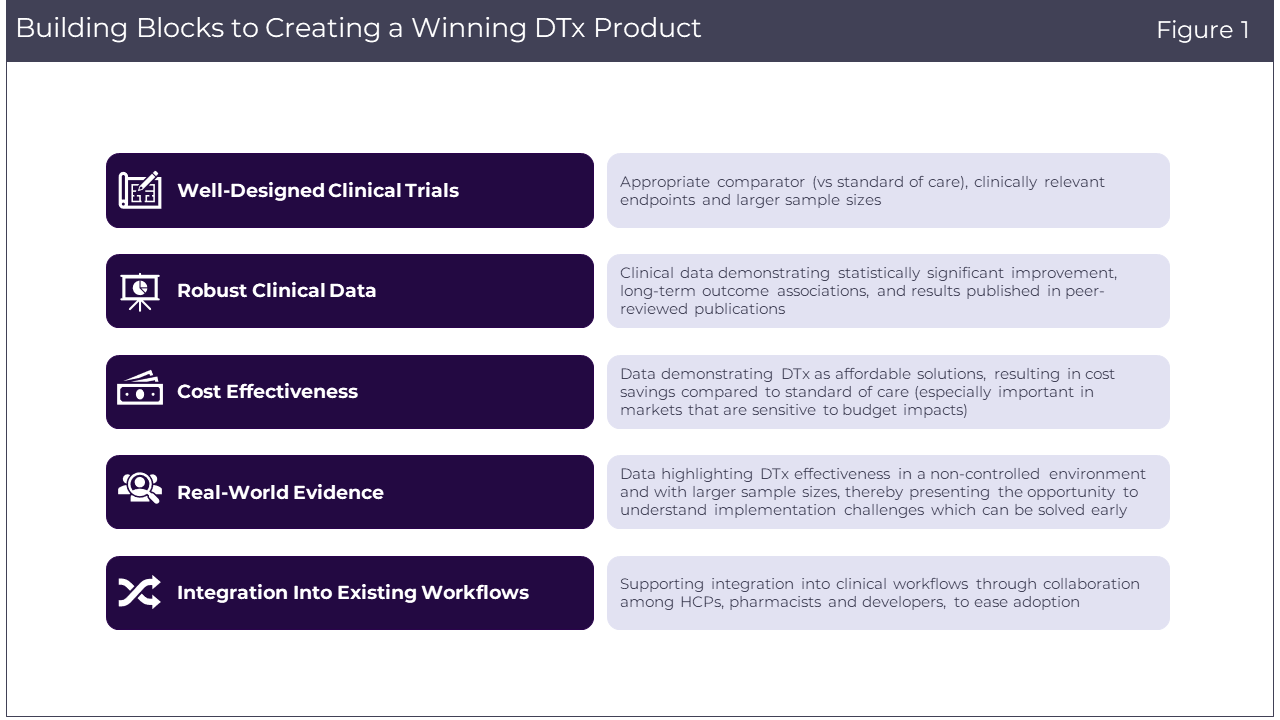

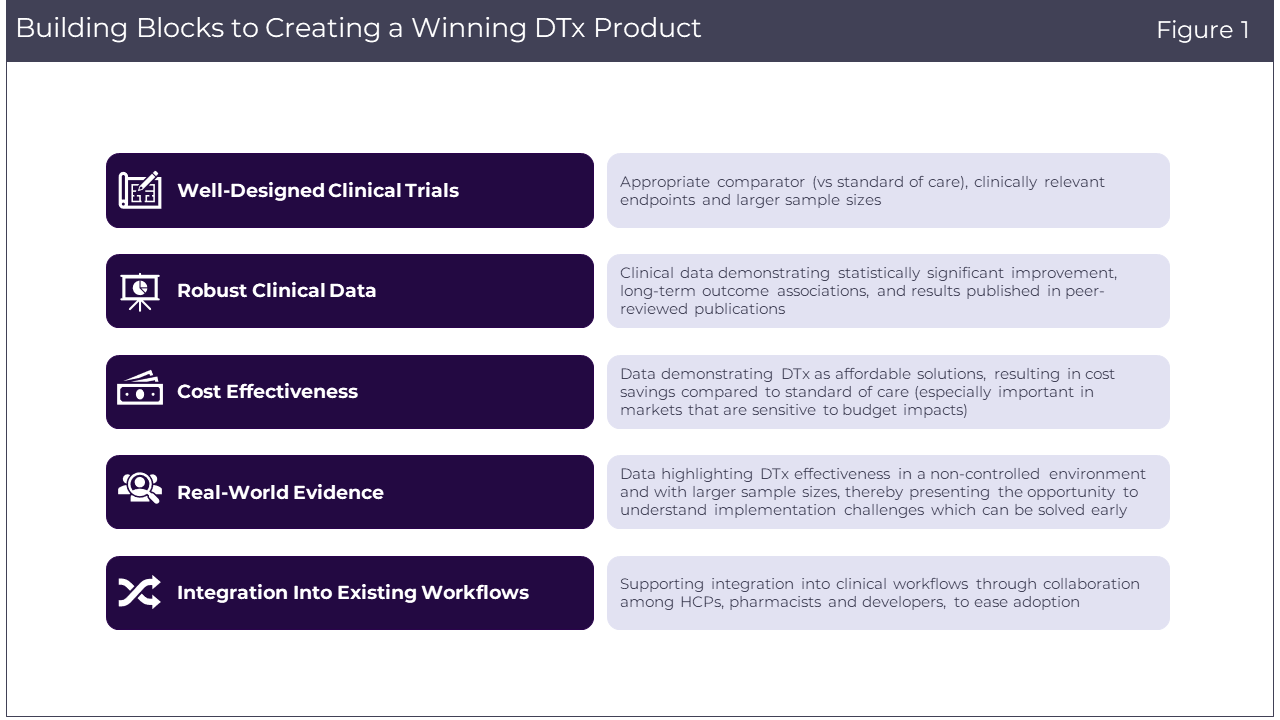

Addressing the complex adoption challenges faced by DTx requires a multifaceted approach. There are several key strategies highlighted by payers and Medical Affairs leaders that can pave the way for better adoption (Figure 1).

- Well-designed clinical trials: To bolster the credibility of DTx, well-designed clinical trials are crucial. These trials should feature:

– Appropriate comparator (vs. standard of care): Utilizing a suitable comparator helps establish the effectiveness of DTx products relative to existing treatments.

– Clinically relevant endpoints: Including endpoints related to patients’ quality of life and well-being provides a more comprehensive understanding of the product’s impact.

– Reflective patient sample sizes: Patient sample size should be reflective of the epidemiological data of the specific disease, although this may vary across different indications and disease areas.

- Robust clinical data: The strength of clinical data plays a pivotal role in the acceptance of DTx. Developers should aim for:

– Statistically significant improvement: DTx interventions must demonstrate statistically significant improvements compared to the standard of care.

– Long-term outcome associations: Endpoints chosen for evaluation should be associated with longer-term patient outcomes, especially in the context of chronic conditions.

– Peer-reviewed publications: Data and findings must be published in reputable, peer-reviewed journals to establish their credibility and reliability.

- Cost effectiveness: DTx interventions should be positioned as less costly alternatives that don’t compromise the quality of patient care. Demonstrating financial savings is vital, especially in countries like the UK where cost-effectiveness is key to decision-making.

- Real-world evidence: Incorporating real-world evidence is an essential step toward understanding how DTx products perform in non-controlled, real-world settings. This approach offers several advantages:

– Non-controlled environments: Real-world data can showcase how DTx products function in everyday patient contexts, providing a better understanding of their effectiveness.

– Larger sample sizes: Real-world settings will allow for larger sample sizes, which can further validate the performance and implementation of DTx.

– Highlighting implementation challenges: Real-world evidence will not only highlight the benefits but also the challenges of implementing DTx solutions.

- Integration into existing clinical workflows: Supporting integration into EMR or other data/clinical workflows through collaboration among HCPs, pharmacists and DTx developers can minimize the burden of use and facilitate adoption.

Paving the way for DTx excellence: How Medical Affairs can make a difference

Medical Affairs professionals can play a pivotal role in bridging the gap between DTx and healthcare providers, offering clinical expertise and guidance to facilitate their integration into patient care. Their deep understanding of the medical landscape and DTx solutions positions them as valuable allies in driving the adoption of these innovative therapies. As part of this study, we wanted to better understand the evolving role of Medical Affairs in DTx development and future best practices that would be fit for purpose.

Medical Affairs leaders acknowledge that currently, the key responsibility is to develop integrated medical evidence plans for DTx products. However, opportunity assessment for DTx products, developing publication and medical communication plans during launch, educating stakeholders about DTx products, and identifying adoption barriers post-launch are increasingly becoming primary responsibilities. Furthermore, engaging with key opinion leaders (KOLs) and payers early on can define compelling evidence, including aspects like trial design, comparators, and the desired level of clinical benefit to support payer coverage, inclusion in treatment guidelines, and physician adoption.

We inquired with Medical Affairs leaders about the readiness of current teams to facilitate successful DTx launches. ~45% of the respondents highlighted the requirement for additional personnel, unanimously agreeing on the necessity of dedicated medical science liaisons (MSLs) specializing in DTx. It is worth noting that both payers and Medical Affairs leaders share the conviction that HCPs’ skepticism regarding the effectiveness of DTx remains a significant impediment to their adoption. Thus, the continued engagement with healthcare providers, supported by dedicated MSLs, emerges as a critical element in overcoming this challenge and ensuring the sustained acceptance of DTx.

Conclusion

It is essential to recognize that the DTx landscape is still evolving, and the contributions of Medical Affairs will play an integral role in the success of this innovative field.

At Putnam, we understand the complexities and opportunities within the digital therapeutics industry. Whether it is horizon scans/competition analysis, market landscape analysis, target product profile development, integrated evidence generation plans, or go-to-market and stakeholder engagement strategies, we offer a comprehensive suite of services tailored to help bridge the critical gaps and bring your digital therapeutic solutions to the patients who need them most.

To learn more about how Putnam can assist your organization in realizing the full potential of digital therapeutics, feel free to get in touch with us. Together, we can shape the future of healthcare and improve patient outcomes through the power of digital therapeutics.

Sources:

- Putnam Primary Market Research, Q3 2023

- National Library of Medicine. 2023. [Online]. Available from: https://clinicaltrials.gov/. [Accessed November 2023].

- Jennings, K. Pear therapeutics files for bankruptcy as CEO blames shortfalls on insurers. Forbes. [Online]. Available from: https://www.forbes.com/sites/katiejennings/2023/04/07/pear-therapeutics-files-for-bankruptcy-as-ceo-blames-shortfalls-on-insurers/?sh=4655668e2bd6. [Accessed April 2023].

- Park, A. Akili cuts workforce another 40%, pivots to selling digital therapeutics over the counter. Fierce Biotech. [Online]. Available from: https://www.fiercebiotech.com/medtech/akili-cuts-another-40-workforce-amid-plan-move-digital-therapeutics-otc-model. [Accessed September 2023].

- Bundesinstitut fűr Arzneimittel und Medizinprodukte. [Online]. Available from: https://diga.bfarm.de/de/verzeichnis. [Accessed November 2023].