Research Contributors: Andris Ortmanis, Sr. Director; Anshu Mittal Roy, Director; Asha Shelly, Manager; Shivali Jasrotia, Manager

We set out to understand the likelihood of regulatory approval of oncology-based single-arm trials by the European Medical Agency (EMA). Our hypothesis was that the EMA looks unfavorably at SATs, however, the data we reviewed suggests otherwise. Our analysis of oncology filings over the past 5 years (2018-2022) suggests that ~90% of SAT-based Marketing Authorization Applications (MAA) resulted in either Conditional Marketing Authorizations (CMA) or Full Approvals (FA) in Europe. While the focus of this thought piece is on the EMA’s track record of oncology SATs, acceptance of SATs by HTAs is an equally important consideration not covered currently. Additionally, the move towards joint HTA/regulatory clinical assessments from 2025 will make decision making increasingly intertwined.

Overview of oncology SAT submissions and approvals

The 45 MAA SAT submissions to the EMA from 2018 to 2022 resulted in 41 approvals with an equal mix between solid tumors and heme malignancies. By contrast, oncology SATs contributed to 94 approvals in the US with the FDA, more than double the number with the EMA, a third of which were for LCM indications for the same drug. While these statistics clearly support a higher level of SAT-based approvals by the FDA versus the EMA, the data also suggest that the EMA tends to be more stringent in granting multiple SAT-based approvals for the same drug. Interestingly, cell therapies in heme malignancies constituted >50% of all full approvals, given their high RR and durability of responses. Full approvals granted to non-CAR-Ts were supported by robust additional clinical evidence provided during their evaluation, which included results with longer patient follow-up and/or evidence from the supportive studies. Three tissue agnostic (TA) approvals were also granted (though 12 TAs to date seen in the US), suggesting that SAT-based MAAs must meet or exceed certain stringent criteria for them to be granted.

Interestingly, cell therapies in heme malignancies constituted >50% of all full approvals, given their high RR and durability of responses. Full approvals granted to non-CAR-Ts were supported by robust additional clinical evidence provided during their evaluation, which included results with longer patient follow-up and/or evidence from the supportive studies. Three tissue agnostic (TA) approvals were also granted (though 12 TAs to date seen in the US), suggesting that SAT-based MAAs must meet or exceed certain stringent criteria for them to be granted.

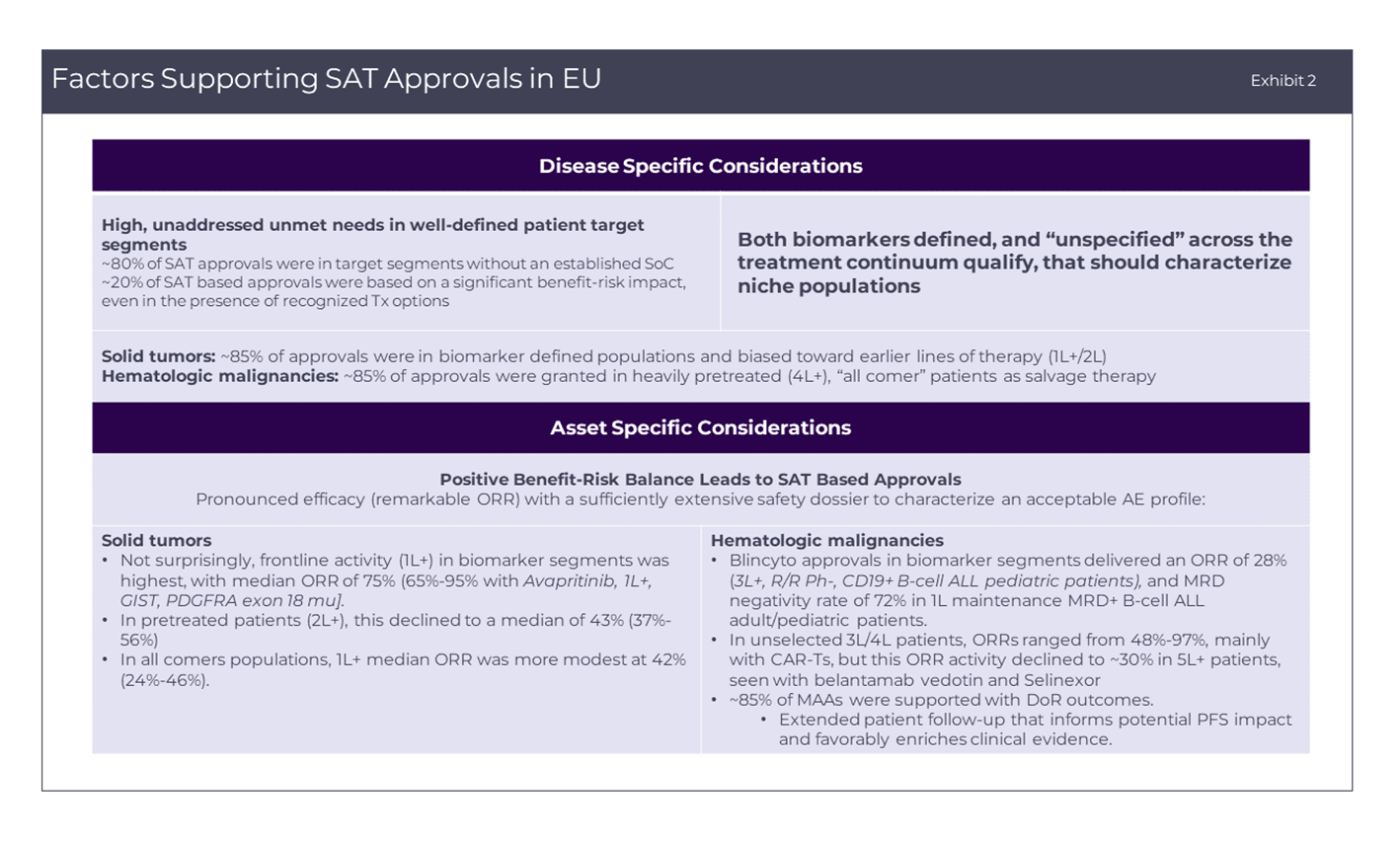

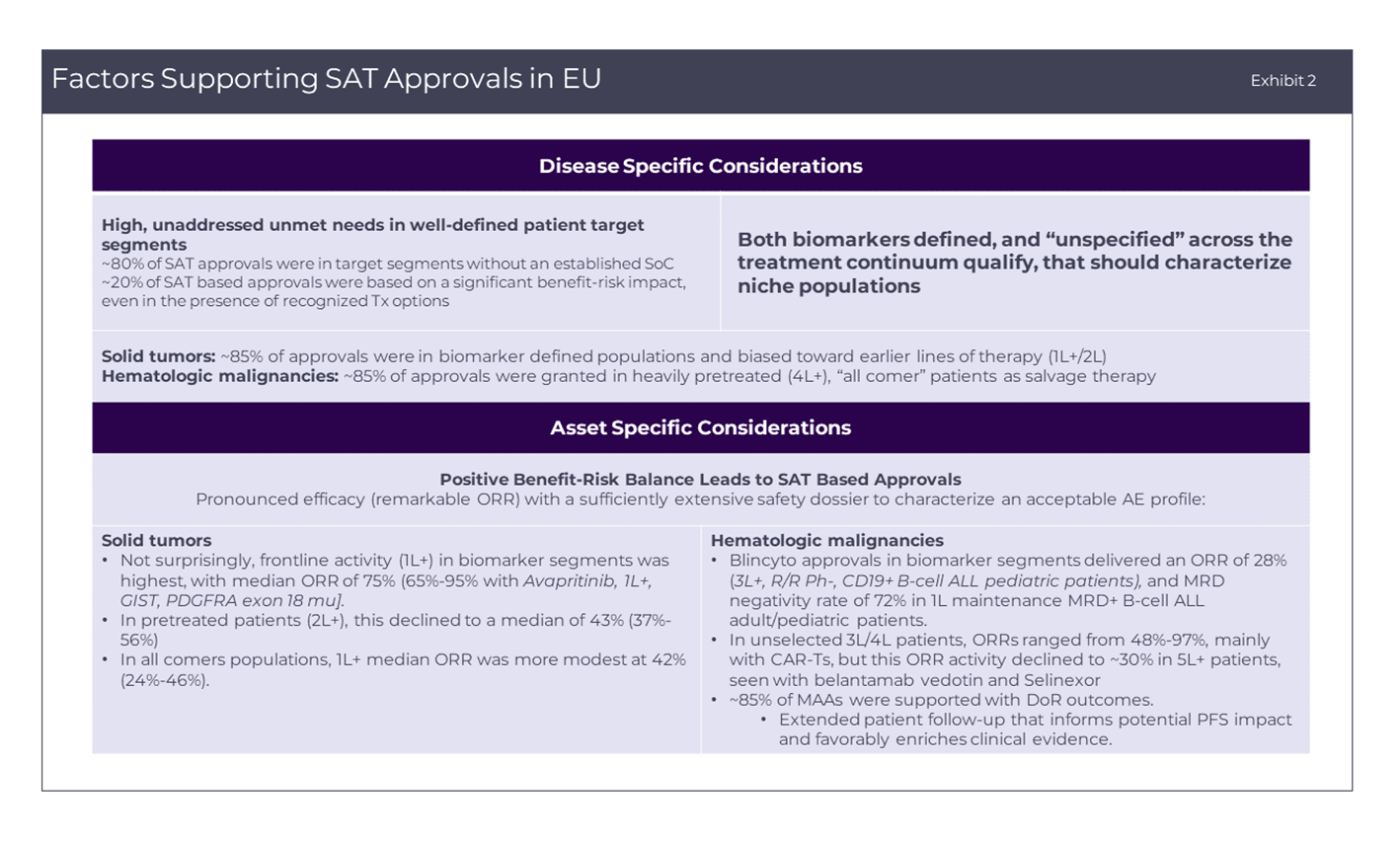

Factors supporting SAT approvals in EU

Successful SAT-based approvals in the EU are characterized by clinical development in high unmet need patient segments without established treatment options, in which the proposed agent demonstrates strong indicators of activity, minimum of 25% ORR in heavily pretreated patients to up to 95% ORR in L1 (and durability of responses). More commonly, these segments are defined by aberrant actionable biomarkers (50% of SAT–based approvals) and/or are supported by comparison to a well-matched historical control or real-world evidence (RWE) dataset (58.5% of SAT-based approvals) as detailed in Exhibit 2. However, the absolute requirement for these external comparators can be obviated by well-conceived SAT strategies – for example, by designs that confirm differential activity in the target biomarker segment versus all patients in the accrued population. As a specific example, Pemigatinib (PEMAZYRE) was granted a CMA for progressive cholangiocarcinoma (CCA) harboring FGFR 1/ 2 alterations that included distinct FGFR 1/2 altered and non-FGFR1/2 altered cohorts. The differential activity in the FGFR1/2 altered patients, together with the sponsor’s commitments to provide results from an ongoing Phase III study in L1 FGFR2-rearranged CCA, was sufficient to support its CMA.

However, the absolute requirement for these external comparators can be obviated by well-conceived SAT strategies – for example, by designs that confirm differential activity in the target biomarker segment versus all patients in the accrued population. As a specific example, Pemigatinib (PEMAZYRE) was granted a CMA for progressive cholangiocarcinoma (CCA) harboring FGFR 1/ 2 alterations that included distinct FGFR 1/2 altered and non-FGFR1/2 altered cohorts. The differential activity in the FGFR1/2 altered patients, together with the sponsor’s commitments to provide results from an ongoing Phase III study in L1 FGFR2-rearranged CCA, was sufficient to support its CMA.

MAA rejections can provide additional insights to strengthen SAT MAAs

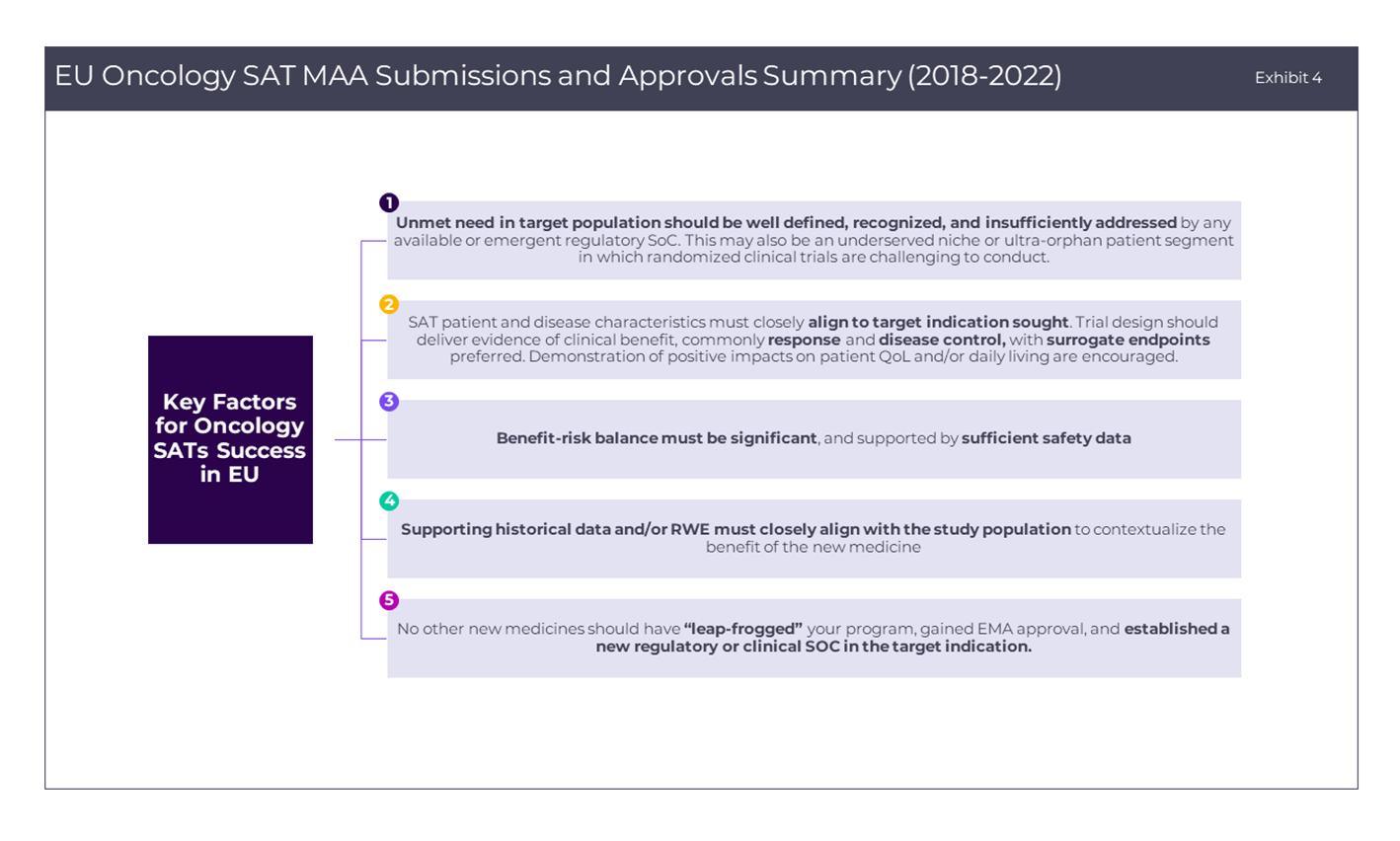

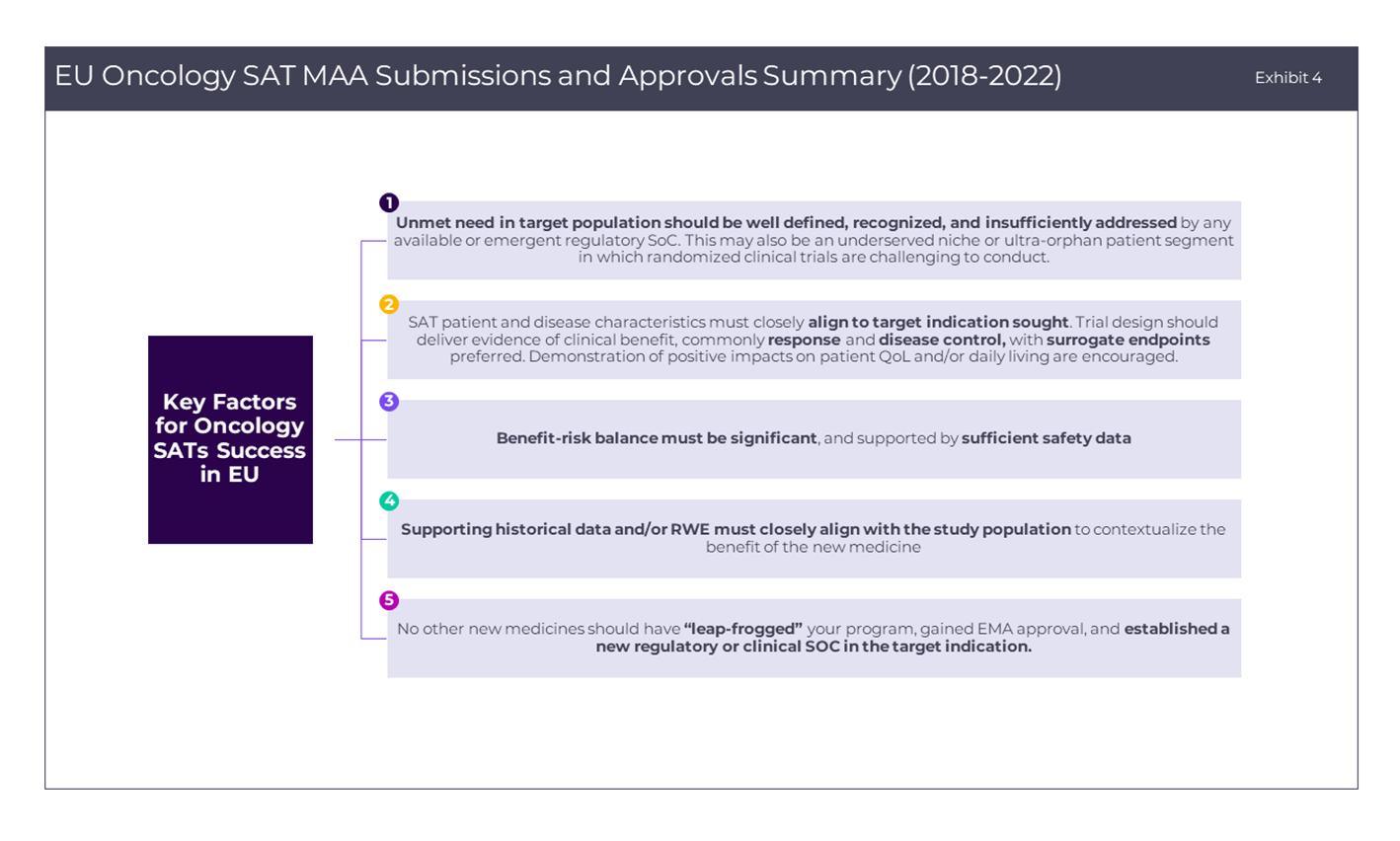

Besides the factors that have been discussed above, reasons for an EMA rejection of a SAT-based application provide additional insights for sponsors to improve approval prospects (as detailed in Exhibit 3 below). In closing, Exhibit 4 summarizes key success factors for sponsors designing oncology SATs for filing with the EMA. Seeking to provide innovative therapeutic options through expedited approval mechanisms for patients with limited options is a noble objective in oncology and beyond, but one that requires a laser-focused development and regulatory strategy and early scientific discussions with regulatory bodies to enhance the likelihood of success. Additionally, while gaining EMA regulatory approval is one side of the coin, another equally important consideration is gaining favorable market access with relevant European HTA bodies (a topic we will explore in a next thought piece).

In closing, Exhibit 4 summarizes key success factors for sponsors designing oncology SATs for filing with the EMA. Seeking to provide innovative therapeutic options through expedited approval mechanisms for patients with limited options is a noble objective in oncology and beyond, but one that requires a laser-focused development and regulatory strategy and early scientific discussions with regulatory bodies to enhance the likelihood of success. Additionally, while gaining EMA regulatory approval is one side of the coin, another equally important consideration is gaining favorable market access with relevant European HTA bodies (a topic we will explore in a next thought piece).

Interestingly, cell therapies in heme malignancies constituted >50% of all full approvals, given their high RR and durability of responses. Full approvals granted to non-CAR-Ts were supported by robust additional clinical evidence provided during their evaluation, which included results with longer patient follow-up and/or evidence from the supportive studies. Three tissue agnostic (TA) approvals were also granted (though 12 TAs to date seen in the US), suggesting that SAT-based MAAs must meet or exceed certain stringent criteria for them to be granted.

Interestingly, cell therapies in heme malignancies constituted >50% of all full approvals, given their high RR and durability of responses. Full approvals granted to non-CAR-Ts were supported by robust additional clinical evidence provided during their evaluation, which included results with longer patient follow-up and/or evidence from the supportive studies. Three tissue agnostic (TA) approvals were also granted (though 12 TAs to date seen in the US), suggesting that SAT-based MAAs must meet or exceed certain stringent criteria for them to be granted. However, the absolute requirement for these external comparators can be obviated by well-conceived SAT strategies – for example, by designs that confirm differential activity in the target biomarker segment versus all patients in the accrued population. As a specific example, Pemigatinib (PEMAZYRE) was granted a CMA for progressive cholangiocarcinoma (CCA) harboring FGFR 1/ 2 alterations that included distinct FGFR 1/2 altered and non-FGFR1/2 altered cohorts. The differential activity in the FGFR1/2 altered patients, together with the sponsor’s commitments to provide results from an ongoing Phase III study in L1 FGFR2-rearranged CCA, was sufficient to support its CMA.

However, the absolute requirement for these external comparators can be obviated by well-conceived SAT strategies – for example, by designs that confirm differential activity in the target biomarker segment versus all patients in the accrued population. As a specific example, Pemigatinib (PEMAZYRE) was granted a CMA for progressive cholangiocarcinoma (CCA) harboring FGFR 1/ 2 alterations that included distinct FGFR 1/2 altered and non-FGFR1/2 altered cohorts. The differential activity in the FGFR1/2 altered patients, together with the sponsor’s commitments to provide results from an ongoing Phase III study in L1 FGFR2-rearranged CCA, was sufficient to support its CMA. In closing, Exhibit 4 summarizes key success factors for sponsors designing oncology SATs for filing with the EMA. Seeking to provide innovative therapeutic options through expedited approval mechanisms for patients with limited options is a noble objective in oncology and beyond, but one that requires a laser-focused development and regulatory strategy and early scientific discussions with regulatory bodies to enhance the likelihood of success. Additionally, while gaining EMA regulatory approval is one side of the coin, another equally important consideration is gaining favorable market access with relevant European HTA bodies (a topic we will explore in a next thought piece).

In closing, Exhibit 4 summarizes key success factors for sponsors designing oncology SATs for filing with the EMA. Seeking to provide innovative therapeutic options through expedited approval mechanisms for patients with limited options is a noble objective in oncology and beyond, but one that requires a laser-focused development and regulatory strategy and early scientific discussions with regulatory bodies to enhance the likelihood of success. Additionally, while gaining EMA regulatory approval is one side of the coin, another equally important consideration is gaining favorable market access with relevant European HTA bodies (a topic we will explore in a next thought piece).