Insights from digital trends at ASH 2024 using ClarityNav, a proprietary AI-driven platform

Introduction

The 2024 American Society of Hematology (ASH) Annual Meeting presented a wealth of data, unveiling the latest clinical advancements across the rapidly evolving hematology landscape. The large number of presentations and wide range of commentary generated can be overwhelming to digest and challenging to distill into actionable insights. Given the profound implications this information can have on biopharma strategy and investment decisions, the need arises for efficient, objective, quantitative assessment of the most important updates, as quickly as possible. At Putnam, we used ClarityNav, part of the InizioNavigator.ai suite, to help solve this problem by analyzing digital discussions from ASH 2024.

ClarityNav is an AI-driven tool that offers an efficient, highly automated analysis of large-scale digital discussions, generating quantified, objective metrics on the frequency of mention, sentiment, and emerging trends. Within a week of the conference, our platform generated actionable insights into therapeutic momentum, stakeholder engagement patterns, and under-the-radar opportunities—critical inputs for our clients’ strategic decision-making, ranging from portfolio prioritization and due diligence assessments to clinical development and medical engagement strategies.

In this piece, we demonstrate how ClarityNav’s advanced analytics, combined with Putnam’s human-in-the-loop approach, can guide prioritization efforts, uncover whitespace opportunities, and enhance the competitive positioning of product portfolios as we move into 2025 and beyond.

Key Insights

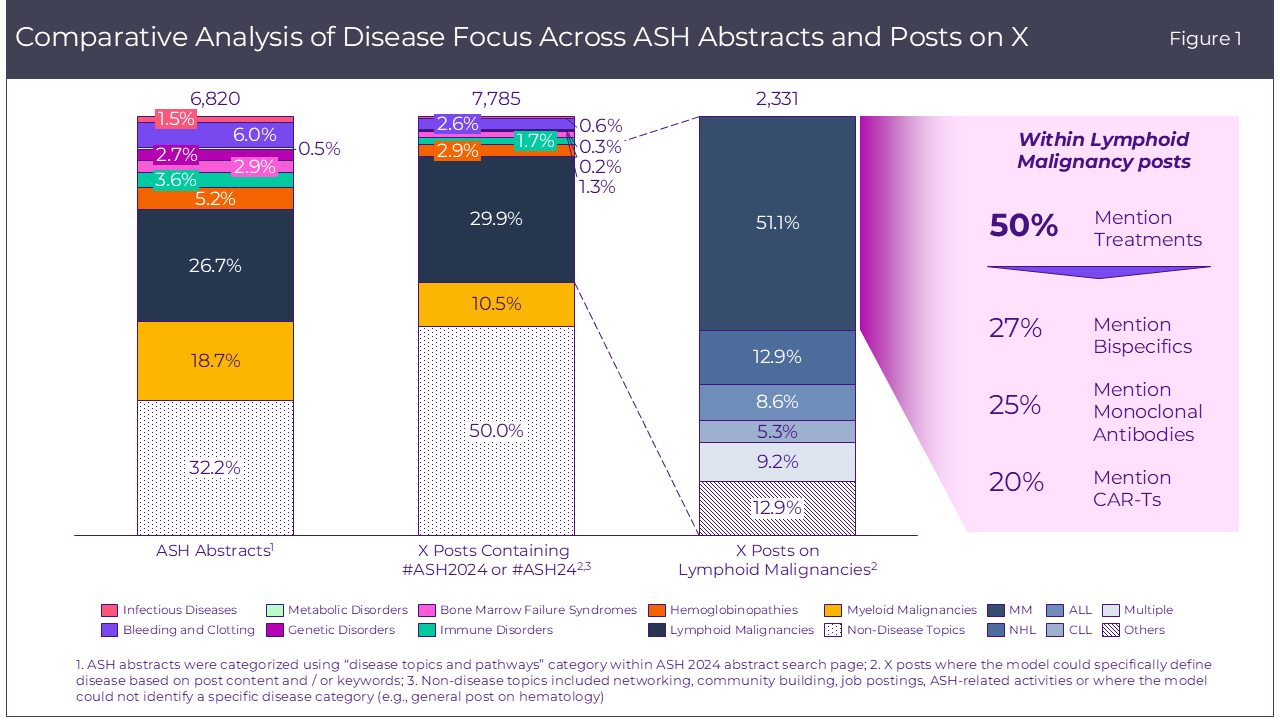

At ASH this year, scientific volume and digital volume1 were dominated by Lymphoid Malignancies (LMs), with Multiple Myeloma (MM) emerging as a key category due to overall volume (Figure 1). For MM, there was a strong alignment between scientific discussions and digital engagement— a trend not consistently observed across other therapeutic areas (e.g., Bleeding and Clotting Disorders or Bone Marrow Failure Syndromes).

1X Posts using #ASH2024 or #ASH2024, collected from 6 December–10 December. Data pulled from X on 11 December, all metrics align to this point in time

A deeper look at the MM data reveals interesting dynamics across four key asset classes in the therapeutic space. Monoclonal Antibodies (mAbs) were the second most frequently mentioned asset class within the set of MM-related posts, appearing in 136 posts (Figure 2). Within these posts, daratumumab was the clear leader, capturing nearly 70% of the volume due to the release of data from the AQUILA and CEPHEUS trials that demonstrate daratumumab’s ability to improve PFS, OS, and MRD negativity across various myelomas. This highlights a clear focus on well-established therapies that continue to generate strong engagement. Antibody drug conjugates (ADCs), though receiving a lower total volume (37 posts), exhibited a similar pattern with nearly all discussion focused on belantamab mafodotin (95%+). This was driven by positive data from DREAMM-7 and DREAMM-8 trials highlighting improved outcomes over standard regimens. This trend of asset specific dominance within a particular asset class is common in the digital space with the release of exciting clinical trial results.

At the asset class level, CAR-T therapies had slightly fewer posts than mAbs (110 posts), while bispecific antibodies (BsAbs) led all four asset classes with 146 posts. Notably, both CAR-T therapies and BsAbs demonstrated dynamics that differed from those of mAbs and ADCs. While there was clear excitement in the discussion of both classes, conversations were less asset specific. For instance, CAR-T assets like ciltacabtagene autoleucel and idecabtagene vicleucel were the two most mentioned CAR-Ts within MM, but only accounted for a combined 33% of posts. Within BsAbs, the leading mentions were the assets teclistamab, talquetamab and etentagmig, which accounted for 65% of the post volume within BsAbs. The overall excitement surrounding these therapeutic classes, and the diversification of specific assets within posts, highlights their still-maturing field, where multiple emerging contenders indicate a pipeline-rich and rapidly evolving landscape. These emerging therapies are shaping the conversation around the future of personalized and highly targeted treatment approaches, emphasizing their strategic importance in the evolving MM treatment landscape.

Highest Engagement Topic

To better understand the leading digital topics generating the most excitement at ASH, posts were analyzed to identify topics of highest engagement (Figure 3). Notably, posts referencing daratumumab’s AQUILA trial stood out, with a remarkable view volume. Using our proprietary platform, this analysis quantifies the AQUILA trial’s digital impact, demonstrating its dominance in an objective and data-driven manner while contextualizing its performance against competitors. Of the 60 posts mentioning the AQUILA trial, the average view/post was five times higher than the average view/post of both all conference posts and MM-related posts. In terms of reposts, posts referencing the AQUILA trial were reposted nearly four times more often than all conference posts and MM-related posts. Similarly, the AQUILA trial posts gained close to three times as many likes/posts compared to all conference posts and MM-related posts. The high digital engagement with AQUILA trial-related posts corresponds with daratumumab’s prominence within the mAbs category, where 69% of the mAbs categorized post specifically mentioned daratumumab. The AQUILA trial’s significant digital presence at ASH highlights its central role in shaping conversations within MM and broader oncology communities, with an overwhelmingly higher level of engagement compared to other topics discussed at the conference.

Identifying Small Signals in the Noise

Beyond dominant headline trends, ClarityNav has value in detecting smaller shifts that might otherwise go unnoticed. Take, for example, the small volume of discussion (15 posts) on hydroxyurea for hemoglobin SC disease (HbSC). Most posts discussed the results of the PIVOT trial, which suggests that hydroxyurea is an effective disease-modifying treatment for individuals with HbSC disease and could lead to significant reductions in painful events and hospitalizations.

Although this therapy has been available since the 1960s, this muted digital footprint suggests a possible opportunity to push momentum. For decision-makers and stakeholders, this gap represents both a challenge and a strategic opening: there is room to shape the narrative, increase education, and drive more informed, widespread dialogue. As the long-term impact of hydroxyurea in HbSC continues to unfold, ClarityNav’s ability to surface these minor signals provides a valuable “watch this space” perspective. By identifying these small but meaningful trends early on, organizations can proactively influence the conversation, sharpen their engagement strategies, and stay well ahead of emerging market dynamics.

Implications

Areas with limited alignment between scientific data and digital engagement may represent untapped opportunities for commercial messaging. Uncovering insights into underexplored areas with high unmet need can guide digital engagement strategies within key indications. For focus areas like MM, where digital momentum mirrors high stakeholder interest, leveraging digital data to prioritize strategic resource allocation and targeted initiatives ensures efforts align with areas of greatest potential impact.

With its timely delivery of data-driven insights, ClarityNav supports a wide range of strategic use cases, from optimizing portfolio investments to informing due diligence and partnership decisions. By translating ClarityNav’s data-driven insights into targeted initiatives, biopharma companies can sharpen their competitive edge, adapt strategies to evolving stakeholder needs, and lead the rapidly shifting hematology landscape. These insights provide a valuable, unaided perspective—capturing spontaneous expressions of interest or reactions to peer commentary—without the biases introduced by traditional research methods, such as primary market research or advisory boards. Our approach delivers a quick, objective pulse on the latest pipeline developments, offering actionable inputs for decision-making across biopharma organizations, from BD&L and clinical development to marketing and medical teams.

Call to Action

Whether you’re navigating the complexities of hematology strategy or looking to assess commercial opportunities, ClarityNav provides a data-driven foundation for success. Combined with Putnam’s deep expertise, we help clients translate insights into actionable strategies that drive meaningful business outcomes. Whether you’re looking to optimize your product launch strategy, refine your digital engagement tactics, or adjust future clinical investments, ClarityNav can provide actionable intelligence and confidence in decision-making.

Contact us today to explore how ClarityNav can transform your approach to both medical and commercial decision-making.

About ClarityNav

ClarityNav, part of InizioNavigator.ai, enables our team to deliver actionable insights to clients more rapidly, empowering them to refine strategies and drive progress. Leveraging this proprietary tool, we apply AI and large language models (LLMs) to classify information and assess sentiment across diverse sources. ClarityNav is brand-agnostic and fully customizable to meet the unique needs of each client.

Acknowledgments

Special thanks to Stephania Irwin, Sophie Lockwood, Prashant Mishra, and Vaibhav Tyagi for their valuable contributions to the analysis and post content.

Jump to a slide with the slide dots.

Rudiger Papsch

Rudiger Papsch

MAPS EMEA 2025: Driving Transformation and Excellence in Medical Affairs

Explore how MAPS EMEA 2025 redefined Medical Affairs - patient-centricity, AI, evidence generation & launch excellence take center stage

Read more Jo Ann Saitta

Jo Ann Saitta

Why AI Needs Humans: The Critical Thinking Advantage in Pharmaceutical Commercialization

AI speeds pharma insights, but human experts turn them into action. ClarityNav blends AI power with strategic, real-world expertise.

Read more Radosław Skowron

Radosław Skowron

Acceptance of Artificial Intelligence in Evidence and Dossier Developments by HTA bodies: Challenges and Opportunities

AI is transforming Health Technology Assessment, but trust, transparency, and clear HTA guidance are key to broader acceptance.

Read more