Key questions to address in early development to maximize asset value

The American Association for Cancer Research (AACR) Annual Meeting is right around the corner, and while the data presented likely won’t make the same splash as presentations at the American Society of Clinical Oncology (ASCO) meeting, learnings from the pre-clinical and early clinical data should be of keen interest to oncology drug developers.

As data starts to read out for emerging technologies and mechanisms – including some headline-grabbers like personalized mRNA therapeutics, Folate Receptor α, and CAR-Ts targeting novel antigens – each of these drug developers (and their competitors) will need to shore up their clinical development strategies.

While pre-clinical data presented at AACR or any other conference doesn’t always translate into clinical evidence, it can point towards where the science is heading. For example, pre-clinical data can yield insights into efficacy and safety of novel mechanisms of action (MoAs), potential combinations, relevant biomarkers, and competitive differentiation, which in turn can inform decisions about external partnership opportunities or First in Human studies. Particularly for an emerging technology or novel MOA – for which clinical evidence may be scant and analogues may be insufficient – it’s important to build a clinical development and go-to-market strategy that’s anchored in a data-driven view of the future landscape.

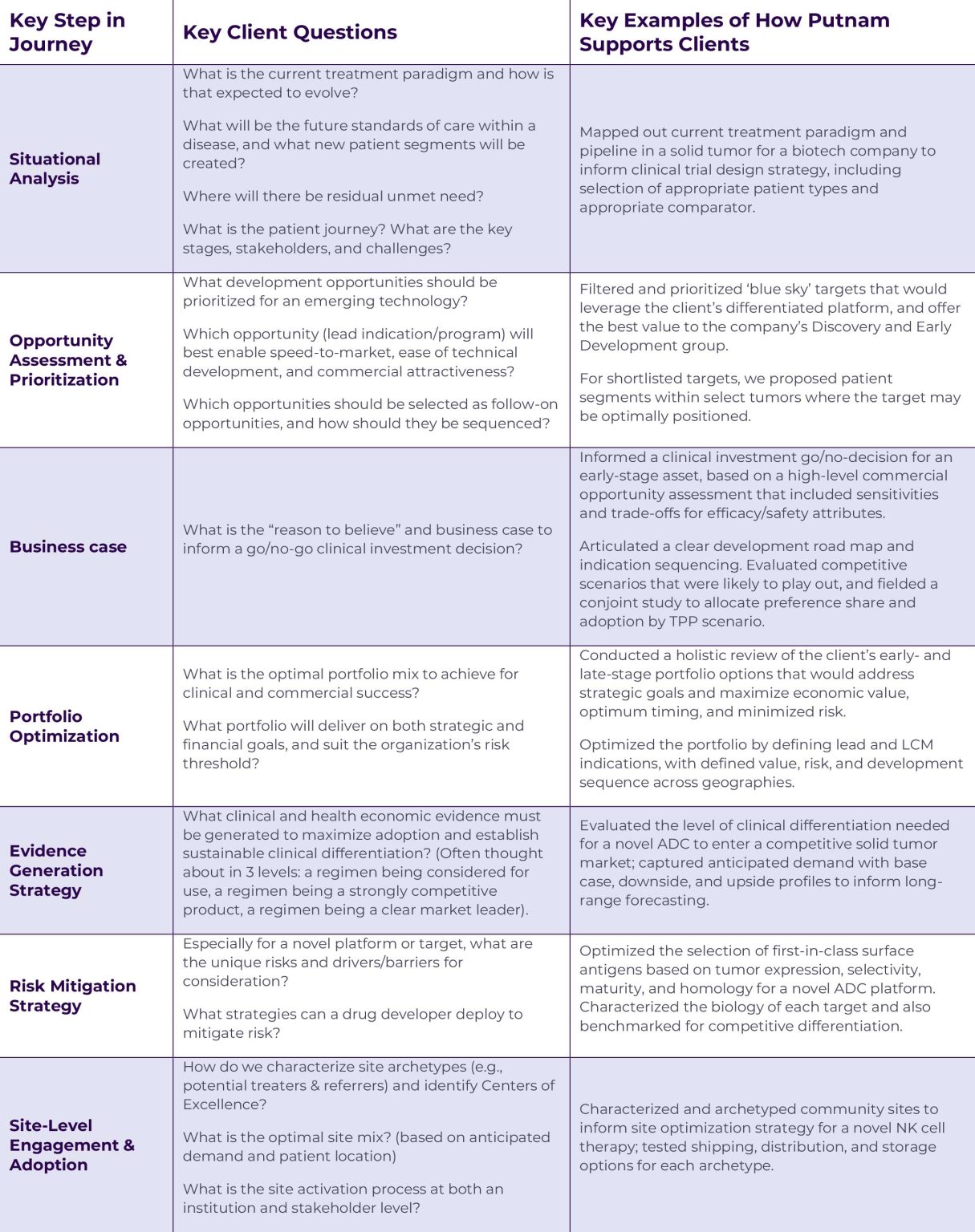

At each stage of clinical development, Putnam helps biopharma companies answer questions that are critical to regulatory approval and commercial adoption:

Pre-clinical and early clinical data isn’t just for basic and translational scientists. Interpreting the data can help us posit hypotheses about probability of success and future competitive scenarios. Developing well-informed answers to these key questions can help companies refine strategies early in development and identify pathways that are less technically risky, faster to market, and more commercially attractive.

Jump to a slide with the slide dots.

Lori Klein, PharmD

Lori Klein, PharmD

How Medical Affairs is Embracing AI to Drive Precision and Impact

Explore how AI is reshaping Medical Affairs, driving precision, enhancing patient outcomes, and unlocking new opportunities for biopharma in 2025

Read more Rudiger Papsch

Rudiger Papsch

MAPS EMEA 2025: Driving Transformation and Excellence in Medical Affairs

Explore how MAPS EMEA 2025 redefined Medical Affairs - patient-centricity, AI, evidence generation & launch excellence take center stage

Read more Jo Ann Saitta

Jo Ann Saitta

Why AI Needs Humans: The Critical Thinking Advantage in Pharmaceutical Commercialization

AI speeds pharma insights, but human experts turn them into action. ClarityNav blends AI power with strategic, real-world expertise.

Read more