Evaluation of Potential Scenarios Around the Removal of the ‘Pill Penalty’ for Medicare Price Negotiations

Authored by: Ann Wechsler, Ethan Johnson, Thomas Marder and Alexander Busch

On April 15th, the White House released an executive order (EO) outlining numerous healthcare policy reforms across a variety of topics, including Medicare price negotiations, payment models, and patient out of pocket costs among others. 1,2 The proclamations were broad and fairly high-level, so there is significant room for interpretation on the specific execution and potential implications of the proposed reforms.

This discussion focuses on EO directives regarding elimination of the “pill penalty” under the IRA’s Medicare Drug Price Negotiation Program (MDPNP), specifically.

Pill Penalty Reform: Aligning Small Molecule Drugs and Biologics

The EO outlines directives to reform the IRA MDPNP “pill penalty” in an effort to eliminate drug price control discrepancies between small molecules and biologics.

Current MDPNP policy exempts part D prescription drugs from Medicare price negotiation based on time since FDA approval. However, the “pill penalty” highlights discrepancies in the duration of exemption wherein small molecules are given 7 years but biologics, 11 years.3 There has been substantial public commentary on how this discrepancy will, intuitively, reduce investment in small molecule drugs4,5. Consequently, the EO intends to “align the treatment of small molecule prescription drugs with that of biological products” 1 While the EO does not specify which exemption period will be revised, we anticipate the policy will extend the 7 year small molecule exemption to 11 years, in line with biologics. The EO confirmed updated guidance will be released within the next 60 days which may provide an update on revision of the “pill penalty”.1

Prospective vs. Retroactive Application: Crucial Policy Considerations

Whether removal of the “pill penalty” is prospective-only or also retroactive will have highly material implications. Retroactive policy would change eligibility for some drugs that are set for “Maximum Fair Price” (MFP) (i.e., the price negotiated by CMS) implementation in 2026 and 2027, as some would be exempt if the 11-year period were applied. Ultimately, we hypothesize that the implementation will be prospective only for several reasons:

- The 10 drugs selected for 2026 have already completed the price negotiation process, have published MFPs, and the manufacturers of these drugs have already concluded negotiations with payers for 2026 access, based on presumed MFPs

- Exempting certain drugs from 2026 and 2027 would lower net Medicare savings, which is contrary to another stated goal of the EO to increase savings. This could manifest in two different ways:

- The now-ineligible drugs are not replaced by other drugs; thus, fewer drugs are negotiated for 2026 and 2027 resulting in lower savings

- The now-ineligible drugs are replaced by other drugs, but the drugs that replace them are inherently lower Medicare gross spend since the ordering of negotiation (after considering various exemptions) is based on gross spend (thus, difficult to achieve the same level of savings when negotiating from a lower cost-basis)

Financial Implications: Impact on 2026 Drug Negotiation Eligibility:

Many of the drugs selected for MFP implementation in 2026 and 2027 would no longer be eligible if the “pill penalty” were applied retrospectively.

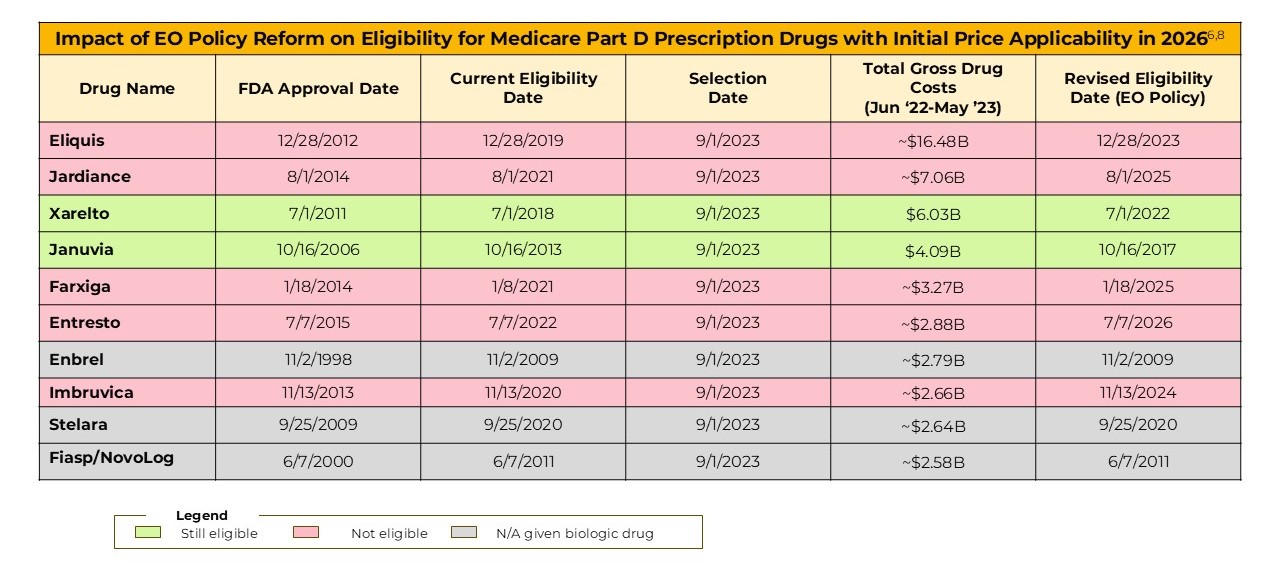

Five of the initial 10 drugs selected for MFP implementation in 2026 would no longer be eligible if removal of “pill penalty” were retroactively applied. This includes the two highest Medicare gross spend drugs selected, Eliquis and Jardiance. Per the table below, Eliquis had over 6-fold the Medicare gross spend versus the 10th highest drug selected for 2026 ($16.4B vs $2.6B), and Jardiance over 3-fold ($7.1B versus $2.6B). Eliquis and Jardiance would theoretically be replaced by drugs in the $2-2.5B gross spend range, substantially reducing Medicare’s ability to achieve savings.

Extended Impacts: The 2027 Medicare Part D Negotiation Scenario

For 2027, eight of the initially selected 15 drugs would no longer be eligible if removal of “pill penalty” were retroactively applied. Once again, this includes the two highest Medicare gross spend drugs currently selected for the year – Novo’s semaglutide brands (Ozempic, Rybelsus, Wegovy) and GSK’s Trelegy Ellipta. The same implications persist regarding diminished savings potential as a result of extending the exemption period for these high spend drugs.

Methodology: Drugs covered under Medicare Part D selected for negotiation for initial price applicability year 2026 and 2027 are based on total gross covered prescription drug costs under Medicare Part D and other criteria, as required by the law. Current policy considers selection eligibility after 7 years for small molecule drugs and 11 years for biologics, from FDA approval.3 We interpret that the EO policy reform proposes aligning small molecules to the 11 year exemption period.1 The FDA approval date used is the date of the first FDA approval date for the drug. The “exemption” date is the date CMS selections were announced, per IRA policy.

Additionally, we anticipate that the selected drugs with “new” eligibility dates which have now passed may be less likely to be retroactively reversed, including Eliquis, Farxiga and Imbruvica from 2026 selections and Otezla for 2027 selection respectively.

Potential for Replacement Drugs: Further Savings Reduction

As noted, even if certain drugs were “pulled forward” to replace the newly exempt drugs, the scale of gross Medicare spend on these drugs is much lower than those initially selected.

If the pill penalty were applied retroactively and CMS sought to pull forward drugs in their place, certain drugs currently selected for price negotiation for 2027 could be pulled forward. Xtandi, Pomalyst, Linzess, Tradjenta, and Xifaxan were not exempt from 2026 based on approval date, but rather weren’t selected as their Medicare gross spend was lower than the top 10 non-exempted drugs. Together, these drugs represent $9.5B of total gross Medicare Part D spend, which is ~3.5 times lower than the 5 exempted products ($32B) for 2026.

Conclusion: Anticipated Policy Direction and CMS Savings

We hypothesize that the EO “pill penalty” reform will not be applied retroactively, given it would result in a dramatic reduction in potential savings for CMS.

References:

- The White House. (2025, April 15). Lowering drug prices by once again putting Americans first. Retrieved from https://www.whitehouse.gov/presidential-actions/2025/04/lowering-drug-prices-by-once-again-putting-americans-first/

- The White House. (2025, April 15). Fact sheet: President Donald J. Trump announces actions to lower prescription drug prices. Retrieved from https://www.whitehouse.gov/fact-sheets/2025/04/fact-sheet-president-donald-j-trump-announces-actions-to-lower-prescription-drug-prices/

- Inflation Reduction Act of 2022, H.R. 5376, 117th Cong. (2022). https://www.congress.gov/bill/117th-congress/house-bill/5376

- Council of Economic Advisers. (2023, October 5). The impact of price setting at 9 years on small molecule innovation under the Inflation Reduction Act. Retrieved from https://bpb-us-w2.wpmucdn.com/voices.uchicago.edu/dist/d/3128/files/2023/10/Small-Molecule-Paper-Final-Oct-5-2023.pdf

- Vital Transformation. (2024, June 25). The potentially larger than predicted impact of the IRA on small molecule R&D and patient health. Retrieved from https://bpb-us-w2.wpmucdn.com/voices.uchicago.edu/dist/d/3128/files/2024/07/Small-Molecule-Paper-20240625.pdf

- Centers for Medicare & Medicaid Services. (2023, August). Fact sheet: Medicare drug price negotiation program—Initial price applicability year 2026. Retrieved from https://www.cms.gov/files/document/fact-sheet-medicare-selected-drug-negotiation-list-ipay-2026.pdf

- Centers for Medicare & Medicaid Services. (2025, June). Fact sheet: Medicare drug price negotiation program—Initial price applicability year 2027. Retrieved from https://www.cms.gov/files/document/factsheet-medicare-negotiation-selected-drug-list-ipay-2027.pdf

- Putnam Internal Analysis

Jump to a slide with the slide dots.

Insights from ISPOR Europe 2025

Key insights from ISPOR Europe 2025 on evolving HEOR, RWE, AI-driven evidence, patient-centered outcomes, and the future of market access.

Read moreUnpacking $100B+ Obesity Market Opportunity: What It Means for Biopharma, Payers, and Providers

As obesity care surges past $100B, biopharma, payers, and providers face a new era of opportunity.

Read moreESMO 2025 Insights: Emerging oncology trends highlighting the need for Precision Medical Affairs

At ESMO 2025, science set the pace, but Precision Medical Affairs defined the path, turning complexity into clarity and innovation into impact.

Read more