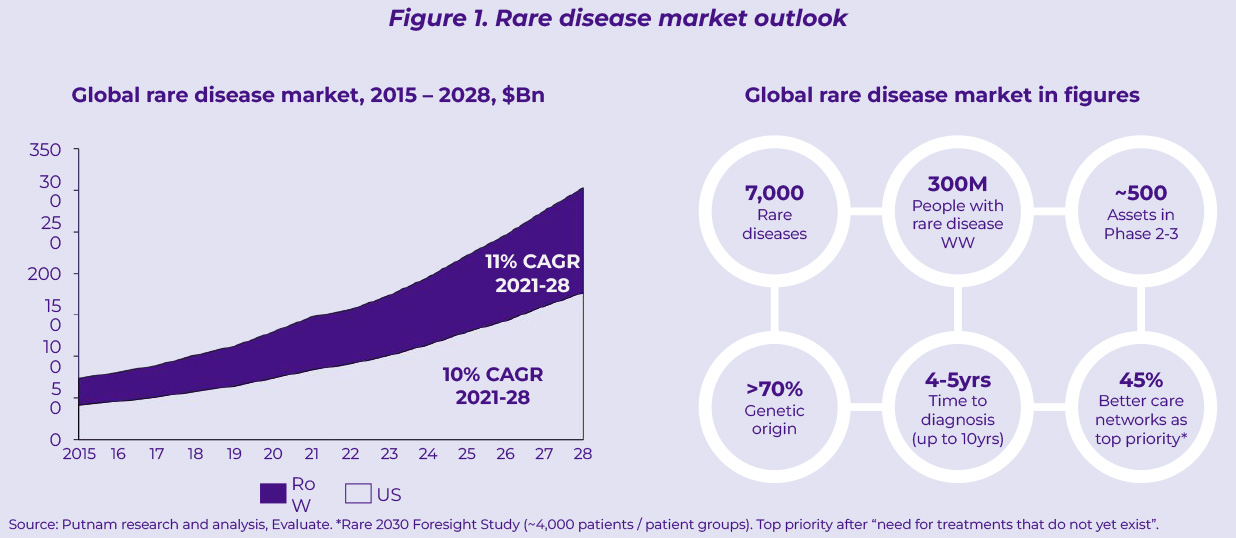

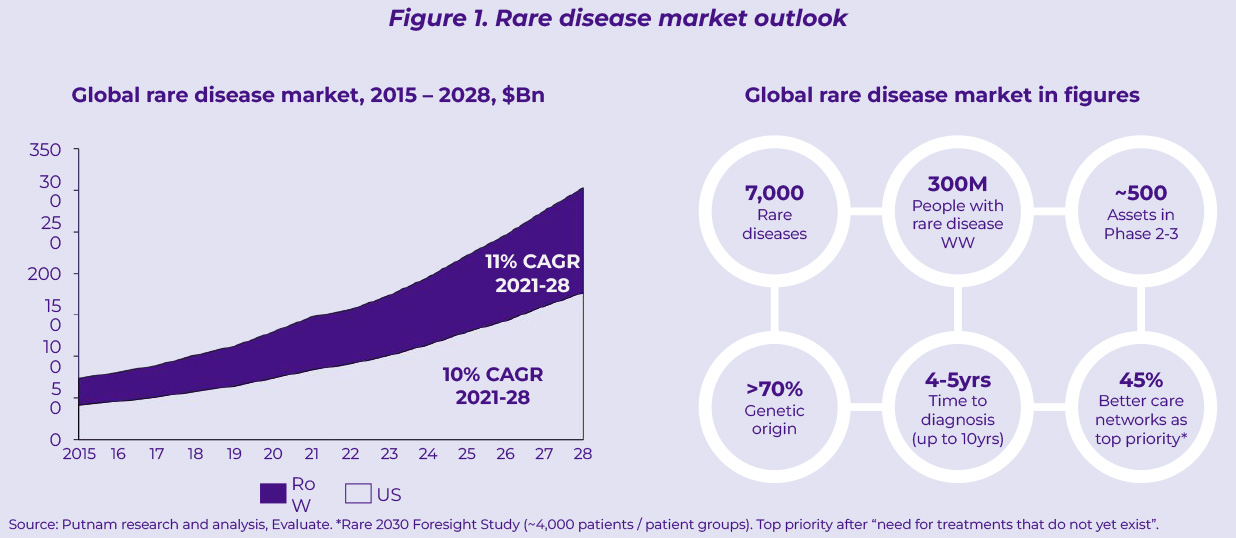

Over the last decade, rare diseases have represented an increasingly popular growth avenue to offset the challenges faced in other mature franchises. The boards of several mid-sized pharma companies have pivoted their increasingly commoditized portfolios towards rare diseases attracted by compelling returns on investment (especially in the US) and the ambition to play an active role in the biopharma innovation ecosystem. As a result, the rare disease market has exhibited remarkable growth over the last 6 years – doubling in size between 2015 and 2021 – and promises to maintain double digit growth through 2028 (11% CAGR between 2021 and 2028, Figure 1). With nearly 500 assets in phase 2-3 development (Figure 1), this field is set to continue growing well beyond 2028, further fueled by advances in precision medicine.

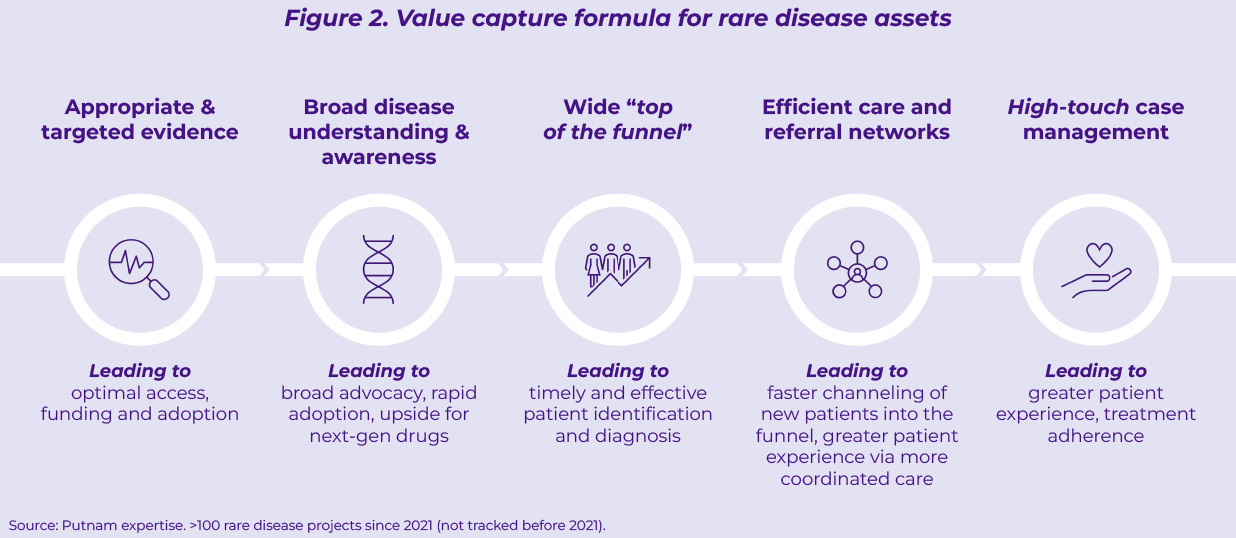

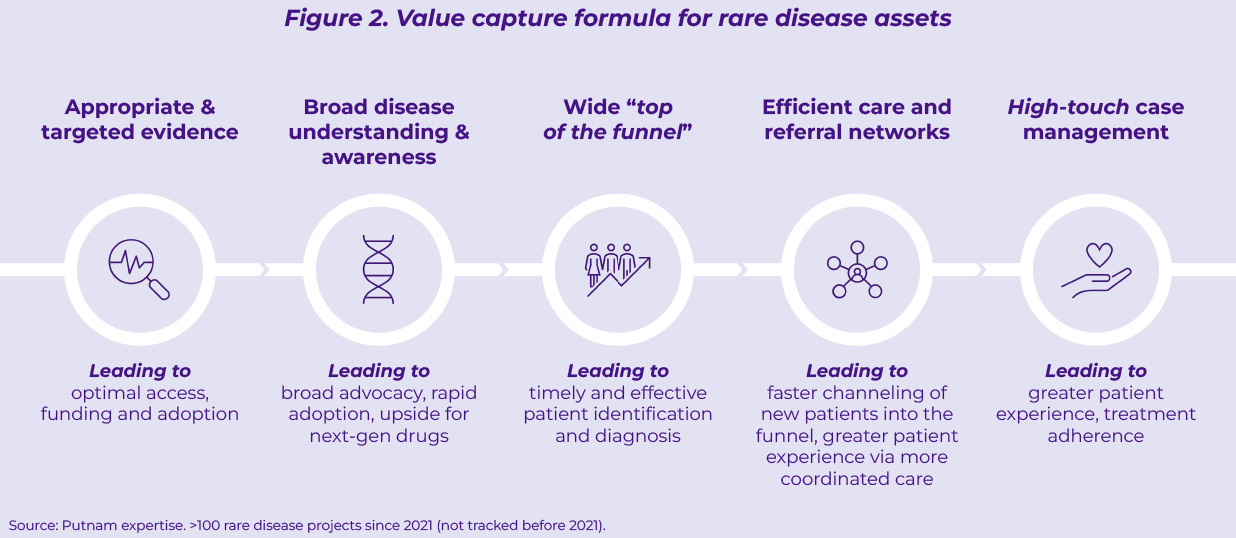

Despite the progress made across many rare diseases, multiple sources of untapped potential and value leakage still exist (Figure 2):

- Partial and uncertain clinical evidence at launch hinders optimal access and funding despite the large unmet medical needs orphan drugs help address.

- Lack of adequate disease understanding and awareness, often caused by limited medical investment (both human capital and early evidence generation) ahead of launch, impairs performance uptake, both in terms of speed and impact.

- A narrow patient funnel due to underdeveloped diagnostic and care pathway infrastructures, limits the demand pool for rare disease assets.

- Sub-optimal care coordination between rare disease centers of excellence and community settings leads to sub-standard treatment experience and adherence. Feedback collected from 4,000 patients via the Rare 2030 Foresight study1(global scope) highlights disjoined care coordination among healthcare professionals as the top priority (~45% of patients) in terms of improvement of care, excluding the need for more efficacious treatment options.

- Scattered use of “high-touch” patient support services leads to fragmented patient experience and treatment adherence.

As the economic outlook for rare disease gets more challenging in established regions (Europe in particular), and large emerging markets such as China are not ready yet to fully offset those headwinds, it becomes critical for current and future players to strengthen their value capture formula by designing new ways to go to market and engage customers.

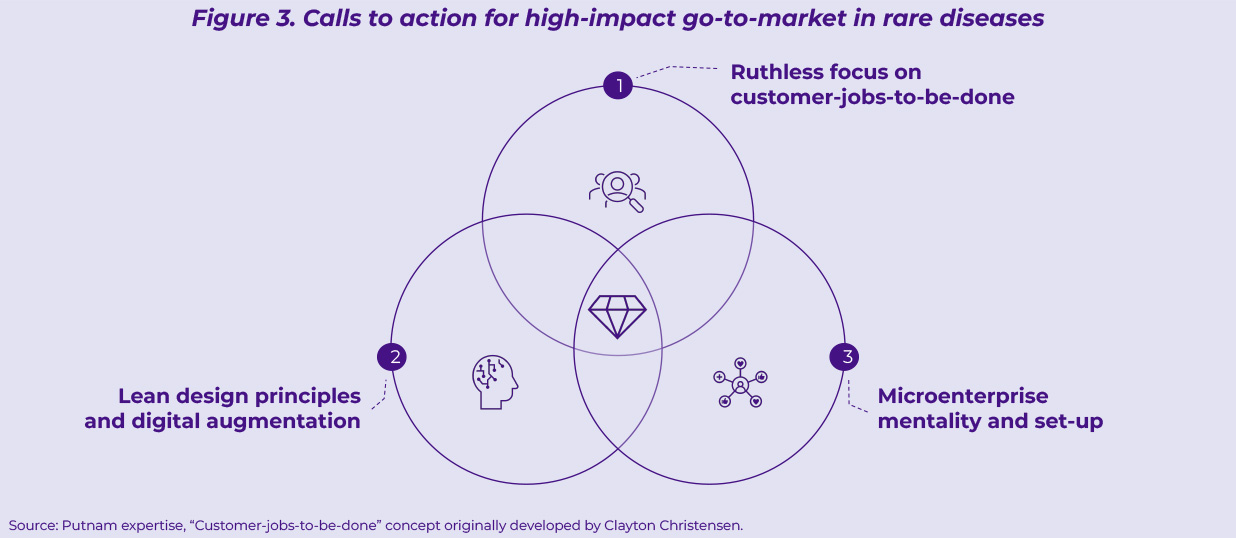

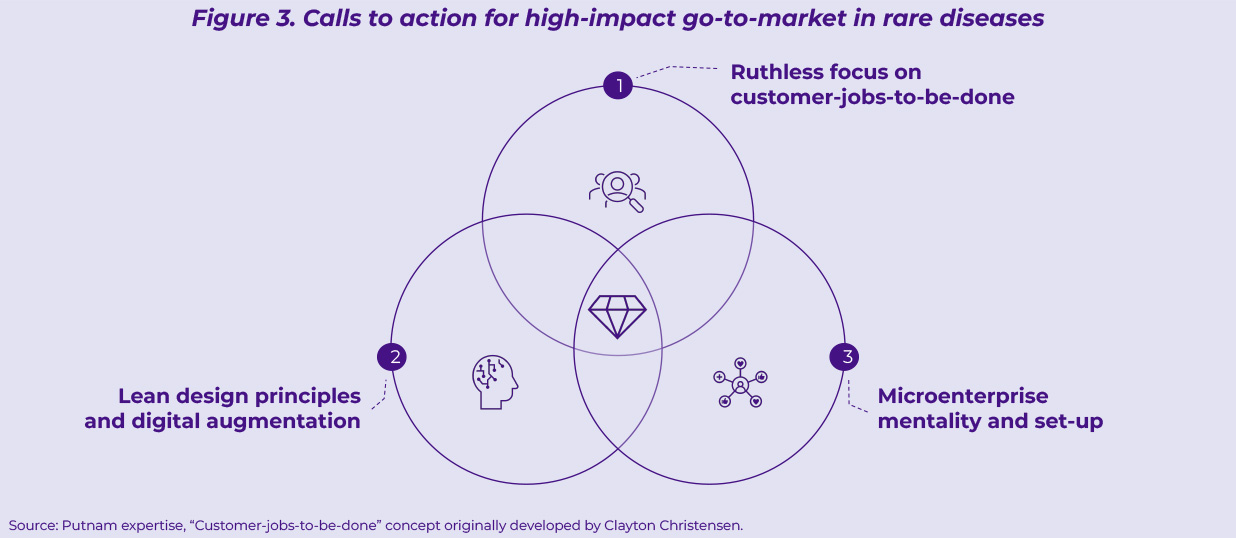

We see three critical calls to action that a successful go-to-market model in rare diseases will need to address (Figure 3).

- Call to action #1: Ruthless focus on customer-jobs-to-be-done3

- Call to action #2: Lean design principles and digital augmentation

- Call to action #3: Microenterprise mentality and set-up

Methodological note4:

The identification of those three calls to action is also based on Putnam’s extensive launch analysis conducted in 2022 where nearly 200 non-COVID drug launches between 2018 and 2021 were reviewed and key performance drivers identified. Assets targeting rare / niche conditions account for approx. 25% of the total sample.

1. Ruthless focus on customer-jobs-to-be-done

Patient journeys in rare diseases are highly fragmented and involve a plurality of stakeholders with complex and heterogeneous needs, but all contributing to the optimal patient experience. Successful companies will be able to unpack real customer needs and dig deeper into the “jobs” customers are seeking to accomplish, by combining advanced analytics and primary insight generation with systematic local co-creation activities driven by customer-facing teams. That will lead to the development of targeted solutions, designed with and for customer groups, tackling key friction points along the patient journey, from novel diagnostic and care pathway approaches (e.g., digital biomarkers, infrastructural investment in newborn screening, novel private-public ways of working) to high-touch patient support services that fully address key emotional, social and functional pain points. Not delivering on this first call to action will impair the overall customer and patient experience, shrink the top of the patient funnel, and hinder broad product adoption (within label) and stickiness.

2. Lean design principles and digital augmentation

Focusing on high impact customer-jobs-to-be-done will enable companies to prioritize efforts on key value streams – one of the key lean design principles – and align investment accordingly. That means unclogging the go-to-market model from all those activities and layers that add limited value and impair speed of execution, experimentation, and the ability to bring innovation as close as possible to customers (e.g., designing new roles and coordination models that cut across borders to maximize the use of limited resources and competences across geographies). But it will also require rare disease players to distance themselves from the legacy go-to-market paradigm by creating (or maintaining, if acquired in-organically) organizational carve-outs that guarantee a distinct focus on rare disease assets and portfolios. Being lean will also mean embracing and experimenting with novel technologies to keep enhancing the care pathway for rare disease patients. For example, the ability of connecting the dots between novel medical and technological solutions, like deep learning AI algorithms that support specific diagnostic tasks, telemedicine and remote patient monitoring will lead to higher diagnostic speed and precision (e.g., classification of specific skin conditions or the recognition of facial phenotypes of genetic disorders based on images, the use of generative-AI tools such as ChatGPT to rapidly flag rare diseases based on symptoms and extensive review of available medical literature). And it will also require the ability to accelerate the integration of specialized centers and community settings5 (even across borders) via a more widespread adoption of telemedicine and virtual networks, data sharing platforms and the use of advanced chatbots to complement in-person case management to support a 24/7 monitoring and support, thus ensuring consistent quality regardless of geographic location. To unfold the full potential of these technologies, and mitigating their risks, rare disease players will need to integrate all the key components (infrastructures and stakeholders) in a seamless, easy-to-use, and ethical platform.

3. Microenterprise mentality and set-up

The connective tissue between the two previous calls to action is the ability to foster a microenterprise mentality. Many parallels can be drawn between launching a rare disease product and a start-up. In the incubation (pre-launch) phase, it will be critical to invest in targeted market development by leveraging hybrid medical-like roles (locally staffed or cross-border task forces), who can both build the necessary advocacy and awareness as well as mapping the key infrastructural bottlenecks that will need to be removed to maximize launch performance. In the activation (peri-launch) phase, successful players will rapidly scale up the incubation teams by creating small and agile entrepreneurial teams that can balance an in-depth understanding and ability to shape local ecosystems, execution excellence and empowerment to drive local decision-making without going through multiple layers of bureaucracy. A few emerging examples have surfaced over the last few years, but overall market development competences are still in their infancy across companies. Developing or hiring those competences is often a key bottleneck for rare disease teams and span both office-based and field-based roles. And it needs to be approached as a continuous effort rather than a one-off exercise. Finally, the third pillar to establish a microenterprise organization is the development of a high-performing set of central platforms to amplify and support the role of customer-facing teams to deliver on the key jobs-to-be-done in a timely fashion (e.g., patient identification tools combining real-world data and AI algorithms, virtual centers-of-excellence, high-touch case management solutions personalized to individual patients).

Delivering on those three calls to action will go a long way in capturing the full value of rare disease assets, as well as broadening patient access to medical innovation in highly underserved areas. While rare diseases are a highly heterogeneous space and grouping them under one label often understates the profound nuances that differentiate them, those three elements remain foundational to secure future go-to-market success.

References:

- Rare 2030 Foresight Study. 2021.

- M. Hirsch, S. Ronicke, M. Krusche, A. Wagner. 2020. Rare disease 2030: how augmented AI will support diagnosis and treatment for rare diseases in the future. Ann Rheum Dis. 79(6):740-743.

- Competing against luck, Clayton Christensen et al. 2016.

- Winning the go-to-market game: standing out in tomorrow’s complex healthcare ecosystems. Putnam. 2022.

- Key challenges for hub and spoke models of care, EHC Think Tank. 2022.